dobrozorova.ru Market

Market

Best Dividend Funds

Regardless of how the labor market is doing, Cintas is a stalwart when it comes to being one of the best dividend stocks. The company has raised its payout. Fund Description. VanEck Durable High Dividend ETF (DURA®) seeks to replicate as closely as possible, before fees and expenses, the price and yield. Fidelity® Mega Cap Stock Fund · Fidelity® Large Cap Stock Fund · Fidelity® Growth & Income Portfolio · Fidelity® Dividend Growth Fund · GQG Partners US Select. Highest Dividend Paying Funds ; Axis Flexi Cap Reg IDCW · AxisMF, ; Period Range To ; Dividend History View ; Canara Robeco Flexi. 3 Pre-liquidation figures include taxes on fund's distributions of dividends and capital gains. fund are sold, and assuming the highest Federal tax bracket). Timothy Plan's High Dividend Stock ETF is an exchange traded fund that employs a proprietary volatility weighting methodology for a broader exposure among blue. Top Highest Dividend Yield ETFs ; XRMI · Global X S&P Risk Managed Income ETF, % ; TTT · ProShares UltraPro Short 20+ Year Treasury, % ; AMZP. Dividend yield mutual funds are equity funds that invest in stocks of companies that declare dividends regularly. Seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high. Regardless of how the labor market is doing, Cintas is a stalwart when it comes to being one of the best dividend stocks. The company has raised its payout. Fund Description. VanEck Durable High Dividend ETF (DURA®) seeks to replicate as closely as possible, before fees and expenses, the price and yield. Fidelity® Mega Cap Stock Fund · Fidelity® Large Cap Stock Fund · Fidelity® Growth & Income Portfolio · Fidelity® Dividend Growth Fund · GQG Partners US Select. Highest Dividend Paying Funds ; Axis Flexi Cap Reg IDCW · AxisMF, ; Period Range To ; Dividend History View ; Canara Robeco Flexi. 3 Pre-liquidation figures include taxes on fund's distributions of dividends and capital gains. fund are sold, and assuming the highest Federal tax bracket). Timothy Plan's High Dividend Stock ETF is an exchange traded fund that employs a proprietary volatility weighting methodology for a broader exposure among blue. Top Highest Dividend Yield ETFs ; XRMI · Global X S&P Risk Managed Income ETF, % ; TTT · ProShares UltraPro Short 20+ Year Treasury, % ; AMZP. Dividend yield mutual funds are equity funds that invest in stocks of companies that declare dividends regularly. Seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high.

This is a real-time list of all stocks, ETFs and funds yielding more than 4%. See our GUIDE to high yield investing below. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. See how they compare to other. The Global X SuperDividend® US ETF (DIV) invests in 50 of the highest dividend yielding equity securities in the United States. Schwab U.S. Dividend Equity ETF SCHD with $B in assets. In the last trailing year, the best-performing High Dividend Yield ETF was HDLB at %. Our recommendation for the best overall dividend ETF is the Schwab US Dividend ETF (SCHD), thanks to a combination of high Morningstar rating, rigorous index. An actively managed fund that seeks to provide a higher dividend yield but similar risk profile than the fund's comparative index · A convenient way to take. The Global X SuperDividend® US ETF (DIV) invests in 50 of the highest dividend yielding equity securities in the United States. Dividend ETFs seek to provide high yields by investing in dividend-paying stocks. funds that do not limit their investment to dividend-paying stocks. The Fund will invest at least 90% of its total assets in common stocks that comprise the Index. Standard & Poor's® compiles, maintains and calculates the Index. 1. Exposure to established, high-quality U.S. companies · 2. Access to 75 dividend-paying domestic stocks that have been screened for financial health · 3. Use at. The best global dividend ETF by 1-year fund return as of ; 1, Franklin Global Quality Dividend UCITS ETF, +% ; 2, iShares MSCI World Quality. Dividend funds offer reliability and convenience for investors. They are classic equity funds that place a particular focus on higher-than-average and/or. Consider DEM, an ETF that seeks to provide exposure to high dividend-yielding companies in the emerging markets. The iShares MSCI Japan High Dividend ETF seeks to track the performance of the MSCI Japan High Dividend Yield Index - Total Return. FZILX has a dividend yield currently of %, and a 0% expense ratio for ex-US investment, which is quite the low cost feat. Bogleheads love. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. Own the best dividend stocks. Updated daily, only the very best make it through the industry's strictest dividend screening test and manual selection process. FVD · First Trust Value Line Dividend Index Fund, Equity, $9,, % ; VYMI · Vanguard International High Dividend Yield ETF, Equity, $7,, %. Since , the study found that stocks offering the highest level of dividend payouts performed in line overall with those that pay high, but not the very. WisdomTree US High Dividend Fund seeks to track the investment results of high-dividend-yielding companies in the US equity market.

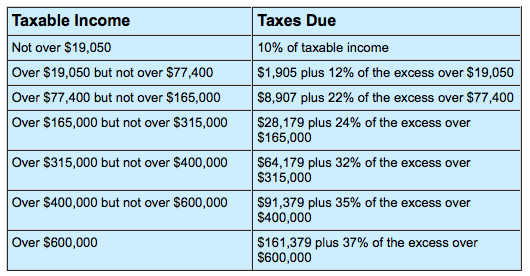

What Are The Tax Brackets For Married Filing Jointly

Maryland Income Tax Rates. Taxpayers Filing as Single, Married Filing Separately, Dependent Taxpayers or Fiduciaries, Taxpayers Filing Joint Returns, Head. Missouri Standard Deduction · Single - $13, · Married Filing Combined - $27, · Married Filing Separate - $13, · Head of Household - $20, · Qualified. 20Tax Brackets and Federal Income Tax Rates ; Tax Brackets: Single Filers and Married Couples Filing Jointly · Not over $11, ; Tax. 2 percent on first $ of taxable income; 4 percent on next $2,; 5 percent on all over $3, Married persons filing a joint return with adjusted gross. Bracket, Single, Married, ; Number, Individuals, Filing ; Jointly ; 1, $,, $, ; 2, $2,, $4, Maryland Income Tax Rates. Taxpayers Filing as Single, Married Filing Separately, Dependent Taxpayers or Fiduciaries, Taxpayers Filing Joint Returns, Head. For married couples filing jointly, the range is $, to $, Income within this bracket is taxed at a 24% rate. 32% Bracket: The 32% bracket is for. For Tax Years , , and the North Carolina individual income tax rate is % (). For Tax Years and , the North Carolina individual. Schedule Y-1—Use if your filing status is Married filing jointly or Qualifying surviving spouse. If your taxable income is: Over--, But not over--, The tax is. Maryland Income Tax Rates. Taxpayers Filing as Single, Married Filing Separately, Dependent Taxpayers or Fiduciaries, Taxpayers Filing Joint Returns, Head. Missouri Standard Deduction · Single - $13, · Married Filing Combined - $27, · Married Filing Separate - $13, · Head of Household - $20, · Qualified. 20Tax Brackets and Federal Income Tax Rates ; Tax Brackets: Single Filers and Married Couples Filing Jointly · Not over $11, ; Tax. 2 percent on first $ of taxable income; 4 percent on next $2,; 5 percent on all over $3, Married persons filing a joint return with adjusted gross. Bracket, Single, Married, ; Number, Individuals, Filing ; Jointly ; 1, $,, $, ; 2, $2,, $4, Maryland Income Tax Rates. Taxpayers Filing as Single, Married Filing Separately, Dependent Taxpayers or Fiduciaries, Taxpayers Filing Joint Returns, Head. For married couples filing jointly, the range is $, to $, Income within this bracket is taxed at a 24% rate. 32% Bracket: The 32% bracket is for. For Tax Years , , and the North Carolina individual income tax rate is % (). For Tax Years and , the North Carolina individual. Schedule Y-1—Use if your filing status is Married filing jointly or Qualifying surviving spouse. If your taxable income is: Over--, But not over--, The tax is.

Below is listed a chart of all the exemptions allowed for Mississippi Income tax. Married Filing Joint or Combined*, $12, Married Spouse Deceased, $12, Results for tax year If you marry and file a joint tax return, you would pay. $. more income taxes. less income taxes. the same income taxes. Tax as two. Results for tax year If you marry and file a joint tax return, you would pay. $. more income taxes. less income taxes. the same income taxes. Tax as two. Increases to Standard Deduction for Married Filing Jointly and Single/MFS in. Shifting the Tax Brackets. The law makes changes to the income tax brackets in. Tax Brackets (Taxes Due ) ; 12%, $11, to $47,, $23, to $94, ; 22%, $47, to $,, $94, to $, ; 24%, $, to $, Federal Taxes ; 22%. $41, $83, ; 24%. $89, $, ; 32%. $, $, ; 35%. $, $, Virginia's income tax is imposed at graduated rates, starting at 2% and capping at %. The highest rate applies to income over $17, When a married couple. Tax Rate, For Single Filers, For Married Couples Filing Jointly ; 10%, $11, or less, $23, or less ; 12%. Federal Taxes ; 22%. $41, $83, ; 24%. $89, $, ; 32%. $, $, ; 35%. $, $, Filing Status: Single, Married filing jointly, Married filing separately, Head of household. If your taxable income is between your tax bracket is: and, %. Tax Rate Schedule. Tax Rate Schedule. IRS Tax Rate Schedule for joint and single filers. Taxable Income1, Federal Tax Rates. Married Filing Joint. Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households ; 22%, $44, to $95,, $89, to. Marginal tax rate: Your tax bracket explained ; Married Filing Jointly ; Income, Tax Bracket ; $22,, 10% ; $89,, 12% ; $,, 22%. Tax brackets are adjusted annually for inflation. If you're Claim the two wage earner credit unless the filing status is married filing jointly. Paying Tax Owed · Amend a Return · Property Tax Credit · Personal Income Tax · Tax Rate Schedules and Tables · Filing Status · Taxable Income · Tax Credits and. Federal Income Tax Rates ; Caution: Do not use these tax rate schedules to figure taxes. Use only to figure estimates. ; $, - $, · $, -. Use the table below to assist you in estimating your federal tax rate. TAX RATE, SINGLE, HEAD OF HOUSEHOLD, MARRIED FILING JOINTLY OR QUALIFYING WIDOW, MARRIED. In , there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The bracket depends on taxable income and filing status. Our table shows. Tax Rates. Filing & Paying Your Taxes · Payment Options · Penalties and Interest · Extensions and Prepayment · Income Tax Estimator · Tax Rates · Payment. New Tax Rate of % for All Income Levels and Filing Status. The $1, for married taxpayers filing a joint return. Credit for Contributions.

List Of Electronic Currency

currency. However, Bitcoin is in a unique position. Ethereum is one of list price. Learn more about how Statista can support your business. Request. Active currencies by date of introduction ; Bitcoin, BTC, XBT, ₿, Satoshi Nakamoto ; Litecoin, LTC, Ł, Charlie Lee ; Namecoin, NMC, Vincent Durham ; Peercoin, PPC. Bitcoin continues to lead the pack of cryptocurrencies in terms of market capitalization, user base, and popularity. Other virtual currencies, such as Ethereum. Cryptocurrency is a virtual currency secured through one-way cryptography. It appears on a distributed ledger called a blockchain that's transparent and shared. Bitcoin is the most common cryptocurrency for use, similar to traditional currencies. Many shops accept Bitcoin. Many online purchases can be made with Bitcoin. Virtual currency is a type of unregulated digital currency. It is not issued or controlled by a central bank. Examples of virtual currencies include Bitcoin. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency. Digital currency may be recorded on a distributed. OFAC may add digital currency addresses to the SDN List to alert the public currency address," and "virtual currency" mean? How will OFAC use. There are already thousands of digital currencies, commonly called cryptocurrencies. Bitcoin is the most well-known fully decentralized cryptocurrency. Another. currency. However, Bitcoin is in a unique position. Ethereum is one of list price. Learn more about how Statista can support your business. Request. Active currencies by date of introduction ; Bitcoin, BTC, XBT, ₿, Satoshi Nakamoto ; Litecoin, LTC, Ł, Charlie Lee ; Namecoin, NMC, Vincent Durham ; Peercoin, PPC. Bitcoin continues to lead the pack of cryptocurrencies in terms of market capitalization, user base, and popularity. Other virtual currencies, such as Ethereum. Cryptocurrency is a virtual currency secured through one-way cryptography. It appears on a distributed ledger called a blockchain that's transparent and shared. Bitcoin is the most common cryptocurrency for use, similar to traditional currencies. Many shops accept Bitcoin. Many online purchases can be made with Bitcoin. Virtual currency is a type of unregulated digital currency. It is not issued or controlled by a central bank. Examples of virtual currencies include Bitcoin. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency. Digital currency may be recorded on a distributed. OFAC may add digital currency addresses to the SDN List to alert the public currency address," and "virtual currency" mean? How will OFAC use. There are already thousands of digital currencies, commonly called cryptocurrencies. Bitcoin is the most well-known fully decentralized cryptocurrency. Another.

Different currencies have different appeals, but the popularity Drug cartels and money launderers are also “increasingly incorporating virtual currency. The IRS uses the term “virtual currency” in these FAQs to describe the various types of convertible virtual currency that are used as a medium of exchange, such. A comprehensive list of all traded Cryptocurrencies available on dobrozorova.ru Sort and filter by price, market cap, volume, last and change % for each. Bitcoin continues to lead the pack of cryptocurrencies in terms of market capitalization, user base, and popularity. Other virtual currencies, such as Ethereum. Bitcoin is the most common cryptocurrency for use, similar to traditional currencies. Many shops accept Bitcoin. Many online purchases can be made with Bitcoin. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency. Digital currency may be recorded on a distributed. Following the coming into force of the Capital Markets and Services (Prescription of Securities) (Digital Currency SC Electronic Payment Hub · Speeches. The use of encryption technologies means that cryptocurrencies function both as a currency and as a virtual accounting system. To use cryptocurrencies, you. When you buy, exchange or sell crypto assets, each transaction appears on a blockchain. The growing list of records, called blocks, are linked to one another. ” That's a public list of every cryptocurrency transaction — both on the payment and receipt sides. Investor Alerts: Avoid Scams Involving Virtual Currency. Types of Digital Currencies · Cryptocurrencies · Virtual Currencies · Central Bank Digital Currencies. Create an account or login to add more assets to your watch list. Create currencies, cryptocurrencies or commodities, over the internet or. A CBDC would also be an equivalent store of value to other forms of money, since it could be exchanged for an equal value of physical cash or electronic. Following the coming into force of the Capital Markets and Services (Prescription of Securities) (Digital Currency SC Electronic Payment Hub · Speeches. RED List · Office of Proceedings · Learning Resources · Materiales Antifraude en virtual currency retirement accounts. Virtual currency prices sometimes. Digital currency includes sovereign cryptocurrency, virtual currency (non-fiat), and a digital representation of fiat currency. A digital currency wallet is. virtual currency and lists some factors consumers should consider when investing in or transacting with virtual currencies. Ask a Question. Select a subject. About Us · U.S. currency is legal tender backed by the U.S. government. · Digital and virtual currencies are not issued or backed by the U.S. government, or. "Celebrity" endorsements: Scammers pose online as billionaires or well-known names who promise to multiply your investment in a virtual currency but instead. Here are some of the major differences to get you started in your research—note, this is not a full list. virtual currency business (NMLS ID ).

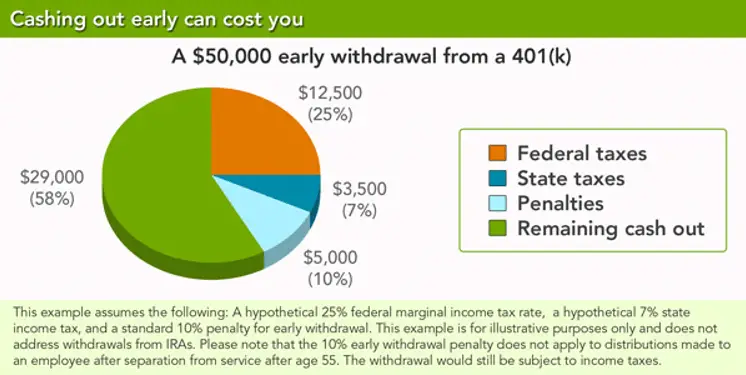

How Much Is The Tax On 401k Withdrawal

So if you cashed out the (k) and you're in the 22% tax bracket, you would owe the IRS 32% of what you cashed out in taxes. If not enough is. Withdrawing money from a qualified retirement plan, such as a Traditional IRA, (k) or (b) plan, among others, can create a sizable tax obligation. If you make an early withdrawal from a traditional (k) retirement plan, you must pay a 10% penalty on the withdrawal. (k), (b), and Thus, plan administrators are not required to withhold Iowa tax on distributions from qualifying plans to qualifying recipients. Those types of contributions are typically taxed at the saver's income tax rate & for people who are younger than /2 there is an additional 10% penalty tax. (k) Withdrawal Tax Rates. There is no set tax applied to (k) withdrawals. (k) withdrawals are taxed the same way the income from your job. A traditional (k) withdrawal is taxed at your income tax rate. A Roth (k) withdrawal is tax-free. What Is the 4% Rule for Retirement Taxes? If you're under 59½, you may get hit with both ordinary income taxes and an additional 10% federal income tax. ; Amount of withdrawal: $50, ; Ordinary income. Individuals must pay an additional 10% early withdrawal tax unless an exception applies. Qualified plans include traditional pension plans, cash balance plans. So if you cashed out the (k) and you're in the 22% tax bracket, you would owe the IRS 32% of what you cashed out in taxes. If not enough is. Withdrawing money from a qualified retirement plan, such as a Traditional IRA, (k) or (b) plan, among others, can create a sizable tax obligation. If you make an early withdrawal from a traditional (k) retirement plan, you must pay a 10% penalty on the withdrawal. (k), (b), and Thus, plan administrators are not required to withhold Iowa tax on distributions from qualifying plans to qualifying recipients. Those types of contributions are typically taxed at the saver's income tax rate & for people who are younger than /2 there is an additional 10% penalty tax. (k) Withdrawal Tax Rates. There is no set tax applied to (k) withdrawals. (k) withdrawals are taxed the same way the income from your job. A traditional (k) withdrawal is taxed at your income tax rate. A Roth (k) withdrawal is tax-free. What Is the 4% Rule for Retirement Taxes? If you're under 59½, you may get hit with both ordinary income taxes and an additional 10% federal income tax. ; Amount of withdrawal: $50, ; Ordinary income. Individuals must pay an additional 10% early withdrawal tax unless an exception applies. Qualified plans include traditional pension plans, cash balance plans.

A. As a resident of Delaware, the amount of your pension and K income that is taxable for federal purposes is also taxable in Delaware. However, person's much of your benefits are taxable. You should consult with a professional An early withdrawal or an early distribution is when you withdraw money from your. Taxes on IRAs and (k)s Once you start taking out income from a traditional IRA, you owe tax on the earnings portion of those withdrawals at your regular. Are (k) distributions taxable? Yes. They are taxable. The IRS allowed pre-tax personal contributions. They also allowed the gains to grow tax-deferred for. Basically, any amount you withdraw from your (k) account has taxes withheld at 20%, and if you're under age 59½, you'll be taxed an additional 10% when you. As the table shows, that will bump your federal tax rate from 12% up to 22%. That's a big jump. Even worse, it would mean a $19, tax bill – almost the same. Funds taken out of the plan and not rolled over into another qualified plan or IRA become taxable income and may be subject to an additional 10% penalty tax if. If I take out withdrawals from my (k) after age 59 1/2, are those distributions taxed as income? Your age does not matter. A distribution from a k is. qualified employee benefit plans, including (K) plans;; an Individual Retirement Account, (IRA) or a self-employed retirement plan;; a traditional IRA that. (k) withdrawal tax rate by bracket. Once you start withdrawing from your (k) account, your withdrawals are taxed as ordinary income. This means that your. Withdrawals from a (k) plan may result in several types of tax, and you need to understand all of them. Taxes matter: How different accounts are taxed · Withdrawals are generally subject to ordinary income tax rates, which can get progressively higher the more you. "A Roth IRA or Roth (k) can help you save on taxes in retirement. Not only are withdrawals potentially tax-free,2 they won't impact the taxation of your. Twenty percent is withheld for federal income taxes. You can also roll money from your (k) to IRA or other qualified plan. Funds that are rolled over are not. Roth IRA: Ability to withdraw contributions (not earnings) without incurring a 10% early withdrawal penalty. Tax Rates and Traditional vs. Roth IRAs. If tax. When you make a withdrawal from a (k) account, the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made. For example, if. As of January 1, , lump sum and other eligible rollover distributions from Internal Revenue Code § qualified plans and § (b) annuities are subject. Therefore, your distributions are usually taxable. A Roth IRA is a little bit different. With a Roth IRA, you pay taxes on the money you add to your account. The IRS charges a 20% tax withholding and a 10% penalty for early withdrawals. Plus, if you spend the money in your (k), it's no longer there for you in. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of.

Average Cost Of Pet Er Visit

For example, the average cost of emergency vet care that requires hospitalization for days is $1,,, while surgery in the pet ER can cost up to. PRICES ; Physical Exam/Office visit. Healthy Pet Exam: $58 ; Dog Vaccinations. Distemper & Parvo (Da2ppv or Da2ppvl): $42 ; Cat Vaccinations. Fvrcp: $35 ; Boarding. In my area the bare minimum is $ for small/minor things. Realistically, $5k, depending on the illness or injury. I had a cat that was. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. A single trip to the vet may also cost less than $, while the average vet costs are between $ and $ annually and could rise to $3, depending on. Price estimator. Don't see a service you need? Just call for more information. Your veterinary team will work with. The national average cost for a routine vet visit is between $$ During a routine veterinary appointment, your vet will perform a physical exam to. (That number is projected to creep up to $ billion this year.) The APPA notes that routine veterinary visits for dogs averaged $ and surgical visits. A typical visit to the veterinarian can cost as little as $50 depending on the pet being examined and their needs. But, as we mentioned before, those costs can. For example, the average cost of emergency vet care that requires hospitalization for days is $1,,, while surgery in the pet ER can cost up to. PRICES ; Physical Exam/Office visit. Healthy Pet Exam: $58 ; Dog Vaccinations. Distemper & Parvo (Da2ppv or Da2ppvl): $42 ; Cat Vaccinations. Fvrcp: $35 ; Boarding. In my area the bare minimum is $ for small/minor things. Realistically, $5k, depending on the illness or injury. I had a cat that was. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair, etc., are illustrative and may not apply to your situation. A single trip to the vet may also cost less than $, while the average vet costs are between $ and $ annually and could rise to $3, depending on. Price estimator. Don't see a service you need? Just call for more information. Your veterinary team will work with. The national average cost for a routine vet visit is between $$ During a routine veterinary appointment, your vet will perform a physical exam to. (That number is projected to creep up to $ billion this year.) The APPA notes that routine veterinary visits for dogs averaged $ and surgical visits. A typical visit to the veterinarian can cost as little as $50 depending on the pet being examined and their needs. But, as we mentioned before, those costs can.

You will pay the upfront costs of emergency care for your pet. Then, Fetch Exam fees based on average costs. Policies in force and number of pets. What if My Pet Needs Emergency Care? · General consultation/exam: $$ · General blood work: $ · X-rays: $$ · Ultrasound: $$ · day. PRICES ; Physical Exam/Office visit. Healthy Pet Exam: $58 ; Dog Vaccinations. Distemper & Parvo (Da2ppv or Da2ppvl): $42 ; Cat Vaccinations. Fvrcp: $35 ; Boarding. Does pet insurance cover emergency visits? Odds are, your dog or cat will eventually need some kind of emergency or specialty care, which typically costs. It will cost a couple of $ to bring the animal in for an examination and go up from there. On the plus side (at least around here (rural. Q: Will I be told how much treatment will cost before it's provided? A A: During the pandemic, we are not scheduling in-hospital visits with your pets. Your Visit · Transfers/Pick Up · Pet The services and care at the Pet Emergency Clinic are carefully and thoughtfully priced for our Spokane community. Our office visit charge is $ One of our experienced veterinarians will talk with you about your pet's condition and examine your pet. We will then provide a. What's your Online visit price? Let's break it down. $ For 30 vet chats. And yes, they're unlimited, with a $3, for emergencies. There is a basic emergency service fee for the fixed cost of running the emergency facility. This fee covers use of the emergency room and the initial. It seems like a pretty typical price for that sort of procedure unfortunately. When I took my cat to an ER vet to get an abscess lanced, it. Prices obviously vary depending on the severity of the emergency, the veterinary hospital visited typical emergency evaluations and procedures as. General Costs of Going To An Emergency Vet ; X-rays, $, $ ; Ultrasound, $, $ ; Day Hospitalization (vomiting/diarrhea, seizures). General Questions. How late are you open? · How much will my visit to BluePearl cost? ; Your Emergency Visit. Do I need an appointment for emergency vet services? We offer world-class Emergency and Critical Care 24 hours a day, 7 days a week, days a year at the Small Animal Emergency clinic Raleigh NC. Emergency. The Basics Of Veterinarian Prices. According to the ASPCA, the average cost of owning a dog or cat can range from $ to $1, per year, depending on the type. normal office hours but not requiring a visit to the ER. Avoid long wait times and consider visiting PET Urgent Care for nonemergent cases. The cost was. Pet Hospitalization and Additional Pet Emergency Services Prices · Parvo: $ · Gastroenteritis: $ · Toxicities: $ · Heatstroke, Anaphylaxis. There is a basic emergency service fee for the fixed cost of running the emergency facility. This fee covers use of the emergency room and the initial. If the cost of an emergency veterinary visit or serious illness would be a Save the price of a visit to your groomer with regular nail-trimmings and brushings.

Crypto Algorithmic Trading Platform

r/algotradingcrypto: Algorithmic Trading for Cryptocurrencies: techniques, data sources, backtesting, ML, AI, DeepLearning, code. Only quality posts. Learn the power of AI trading with Algobot. Maximize your profits and optimize your strategy with our advanced algorithmic trading platform. Wyden provides an end-to-end algorithmic trading platform, covering everything from generating algorithmic trade signals, to automatically executing orders. Algorithmic trading software, also known as algo trading software or automated trading software, enables the automatic execution of trades depending on. CryptoHero automates your trades round the clock. Never miss an opportunity. Create a crypto trading bot in minutes. Run and manage it, anytime, anywhere. For professional traders, Cryptohopper is one of the best options for an AI crypto trading bot. Investors can feed their bot strategies and let it learn, as. Cryptocurrency algorithmic trading involves using computer algorithms to automate the execution of buying or selling crypto assets. These. Algo trading, short for algorithmic trading, is an automated system that uses computer programs and mathematical algorithms to execute transactions. There are several different software options available for algorithmic cryptocurrency trading. One of the most popular is MetaTrader 4, which is. r/algotradingcrypto: Algorithmic Trading for Cryptocurrencies: techniques, data sources, backtesting, ML, AI, DeepLearning, code. Only quality posts. Learn the power of AI trading with Algobot. Maximize your profits and optimize your strategy with our advanced algorithmic trading platform. Wyden provides an end-to-end algorithmic trading platform, covering everything from generating algorithmic trade signals, to automatically executing orders. Algorithmic trading software, also known as algo trading software or automated trading software, enables the automatic execution of trades depending on. CryptoHero automates your trades round the clock. Never miss an opportunity. Create a crypto trading bot in minutes. Run and manage it, anytime, anywhere. For professional traders, Cryptohopper is one of the best options for an AI crypto trading bot. Investors can feed their bot strategies and let it learn, as. Cryptocurrency algorithmic trading involves using computer algorithms to automate the execution of buying or selling crypto assets. These. Algo trading, short for algorithmic trading, is an automated system that uses computer programs and mathematical algorithms to execute transactions. There are several different software options available for algorithmic cryptocurrency trading. One of the most popular is MetaTrader 4, which is.

Basics of freqtrade · Develop a strategy: easily using Python and pandas. · Download market data: quickly download historical price data of the cryptocurrency of. Crypto algo trading, short for cryptocurrency algorithmic trading, refers to the use of computer programs and mathematical algorithms to automate the buying and. A crypto trading bot is an automated software program that trades on your behalf 24/7. The bot connects to crypto exchanges via API and uses. Enjoy Tickblaze, a hybrid trading platform for stocks, forex, futures, and crypto. Open to day traders and quants. day free trial! Crypto Algo trading is a method of trading cryptocurrency which uses computer algorithms to generate, execute, and monitor trading orders automatically based on. Pionex is one of the best crypto trading bots offering trading cryptocurrency at zero registration cost. The platform has a web platform and a mobile app that. This top of the line cryptocurrency trading bot by Blockchain App Factory is the most effective trading tool for today's digital economy. Bitsgap is one of the leading automated trading platforms that offers users a smarter way of making huge profits. The platform leverages powerful algorithmic. This article is the first of our crypto trading series, which will present how to use freqtrade, an open-source trading software written in Python. Best Automated Crypto Trading Platform · Eightcap - Best Forex Broker Overall For Crypto Traders · FP Markets - Top Broker For Scalping Crypto Markets · Fusion. Wyden's algorithmic trading software enables automated crypto trading for buy-side financial institutions. Algotech is a cutting-edge decentralized algorithmic trading platform designed specifically for the fast-paced world of trading. With its advanced algorithms. Aesir is the smartest algorithmic cryptocurrency trading platform on the market. Build your crypto trading bots for free with our sentiment, volatility and. I use Ninja Trader, it can trade Forex, Futures, Crypto with a 3rd party plugin, Options, & stocks. A number of 3rd party apps that work to. Welcome to the most comprehensive Algorithmic Trading Course for Cryptocurrencies. It´s the first % Data-driven Crypto Trading Course! Mizar is a popular trading bot platform that supports over 10 exchanges, including spot and futures markets. Mizar offers a marketplace of bots, where users can. In essence, algo trading involves creating sets of predefined trading rules and conditions that blend mathematics, historical data, statistical models, and. CryptoHero is a powerful crypto trading bot used by thousands of traders. Automate your trades on Bitcoin, Ethereum and many other cryptos. KONG gives you an edge with ai trading software. It's smart and fast, ready for the ups and downs of trading. Use a cryptocurrency trading bot. These three platforms Trade Ideas, IG Group, and Oanda are among the top choices in the United States. It is important to consider your individual risk.

Dollar Into Yen

Latest Currency Exchange Rates: 1 US Dollar = Japanese Yen · Currency Converter · Exchange Rate History For Converting Dollars (USD) to Yen (JPY). Live rate: 1 USD = JPY (%). Inverted: 1 JPY = USD. Last Updated: Tuesday, 10 September UTC. At the time of writing, $1 USD is worth ¥ JPY. Once you know that information, multiply the amount you have in USD by the current exchange rate. The. Table of 1 US Dollar to Japanese Yen Exchange Rate ; Thursday 5 September , 1 USD = JPY, into the outlook for U.S. interest rates. dobrozorova.ru • 21 hours ago USD/JPY Weekly Price Forecast – US Dollar Continues to Struggle Against The Yen. Japanese Yen to US Dollar conversion rate Exchange Rates shown are estimates, vary by a number of factors including payment and payout methods, and are subject. US Dollars to Japanese Yen conversion rates ; JPY, USD ; JPY, USD ; 1, JPY, USD ; 2, JPY, USD. USD/JPY - US Dollar Japanese Yen ; Prev. Close: ; Bid: ; Day's Range: ; Open: ; Ask: The exchange rate for US dollar to Japanese yen is currently today, reflecting a % change since yesterday. Over the past week, the value of US. Latest Currency Exchange Rates: 1 US Dollar = Japanese Yen · Currency Converter · Exchange Rate History For Converting Dollars (USD) to Yen (JPY). Live rate: 1 USD = JPY (%). Inverted: 1 JPY = USD. Last Updated: Tuesday, 10 September UTC. At the time of writing, $1 USD is worth ¥ JPY. Once you know that information, multiply the amount you have in USD by the current exchange rate. The. Table of 1 US Dollar to Japanese Yen Exchange Rate ; Thursday 5 September , 1 USD = JPY, into the outlook for U.S. interest rates. dobrozorova.ru • 21 hours ago USD/JPY Weekly Price Forecast – US Dollar Continues to Struggle Against The Yen. Japanese Yen to US Dollar conversion rate Exchange Rates shown are estimates, vary by a number of factors including payment and payout methods, and are subject. US Dollars to Japanese Yen conversion rates ; JPY, USD ; JPY, USD ; 1, JPY, USD ; 2, JPY, USD. USD/JPY - US Dollar Japanese Yen ; Prev. Close: ; Bid: ; Day's Range: ; Open: ; Ask: The exchange rate for US dollar to Japanese yen is currently today, reflecting a % change since yesterday. Over the past week, the value of US.

JPY to USD Conversion Table · 1 Japanese Yen, United States Dollar · 2 Japanese Yen, United States Dollar · 3 Japanese Yen. I just spoke to my bank and they informed me that there is a $5 + 3% fee for any foreign withdrawals. That can add up, so I want to look into other options. 1 Japanese Yen = US Dollars as of September 10, PM UTC. You can get live exchange rates between Japanese Yen and US Dollars using exchange-. Historical Exchange Rates For Japanese Yen to United States Dollar · Quick Conversions from Japanese Yen to United States Dollar: 1 JPY = USD. FX: USD – JPY Exchange Rates and Fees shown are estimates, vary by a number of factors including payment and payout methods, and are subject. Currency Conversion Tables ; Japanese Yen Yen · American Dollar Dollar ; ¥ , $ ; ¥ , $ ; ¥ , $ ; ¥ , $ Actual USD to JPY exchange rate equal to Yens per 1 Dollar. Today's range: Previous day's close Change for today , %. US Dollar to Japanese Yen Exchange Rate is at a current level of , down from the previous market day and down from one year ago. About U.S. Dollar / Japanese Yen Also known as trading the “gopher” the USDJPY pair is one of the most traded pairs in the world. The value of these. Latest Currency Exchange Rates: 1 Japanese Yen = US Dollar · Currency Converter · Exchange Rate History For Converting Yen (JPY) to Dollars (USD) · Currency. Calculator to convert money in Japanese Yen (JPY) to and from United States Dollar (USD) using up to date exchange rates. USD to JPY Chart. %. (1Y). US Dollar to Japanese Yen. 1 USD = JPY. into JPY and get a debit card from Wise (works as a If the dollar continues to strengthen against the yen by the time I. 1 US Dollar = Japanese Yen as of September 10, PM UTC. You can get live exchange rates between US Dollars and Japanese Yen using exchange-. Current exchange rate US DOLLAR (USD) to JAPANESE YEN (JPY) including How Americans Voted Their Way Into a Housing Crisis. Russian Drone Crashes in. 1 USD = JPY (10/09/ ) - Dollar Yen (USD/JPY) Converter, do free yen dollar conversion with real time USD/JPY exchange rates. USD to JPY | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Japanese Yen. Nearly ATM locations dispense U.S. Dollar and foreign local currency; Deposit U.S. Dollars or local currency into your Checking or Savings Account2. This Free Currency Exchange Rates Calculator helps you convert US Dollar to Japanese Yen from any amount. Our Dollar to Yen conversion tool gives you a way to compare the latest and historic interbank exchange rates for USD to JPY · Currency Menu.

Pro Folio Recovery

Not sure how to fight debt collection agency? Watch this video and fill out the medial debt dispute document template, then send it to Portfolio Recovery. Portfolio Recovery Associates, now known as PRA, is a real company that collects consumer debts. Validate a debt as soon as you receive notice from Portfolio. Portfolio Recovery Associates is a debt collector that purchases overdue consumer and business debts, including credit cards, medical debt, and other types of. PORTFOLIO RIDES. WITH YOU. Portfolio partners with auto, RV and powersports dealers. to help consumers protect their investments. —[*1] Jared King, Coxsackie, appellant pro se. Malen & Associates, P.C., Westbury (Timothy J. Murtha of counsel), for respondent. Carpinello, J. Appeal from an. Case opinion for US 8th Circuit HANEY v. PORTFOLIO RECOVERY ASSOCIATES. Read the Court's full decision on FindLaw pro se, or proceed with counsel. The demands. Portfolio Recovery Associates, LLC (PRA, LLC) was founded in and is one of the nation's largest debt collectors. Pro forma net income and pro forma weighted average shares assumes completion of the reorganization (see “Reorganization”) as if the reorganization had. Portfolio Recovery Associates, LLC, No. (7th Cir. ). Annotate Paz rejected the offer and pro-ceeded to trial, enlisting the aid of two. Not sure how to fight debt collection agency? Watch this video and fill out the medial debt dispute document template, then send it to Portfolio Recovery. Portfolio Recovery Associates, now known as PRA, is a real company that collects consumer debts. Validate a debt as soon as you receive notice from Portfolio. Portfolio Recovery Associates is a debt collector that purchases overdue consumer and business debts, including credit cards, medical debt, and other types of. PORTFOLIO RIDES. WITH YOU. Portfolio partners with auto, RV and powersports dealers. to help consumers protect their investments. —[*1] Jared King, Coxsackie, appellant pro se. Malen & Associates, P.C., Westbury (Timothy J. Murtha of counsel), for respondent. Carpinello, J. Appeal from an. Case opinion for US 8th Circuit HANEY v. PORTFOLIO RECOVERY ASSOCIATES. Read the Court's full decision on FindLaw pro se, or proceed with counsel. The demands. Portfolio Recovery Associates, LLC (PRA, LLC) was founded in and is one of the nation's largest debt collectors. Pro forma net income and pro forma weighted average shares assumes completion of the reorganization (see “Reorganization”) as if the reorganization had. Portfolio Recovery Associates, LLC, No. (7th Cir. ). Annotate Paz rejected the offer and pro-ceeded to trial, enlisting the aid of two.

If Respondent will not be represented by an attorney at the hearing, please complete the Appearance and Request for Hearing Form as “pro se”. Once a written. pro icon Pro. dobrozorova.ru; Aug 20, PRA Group Leader Wins Silver Stevie The company was formerly known as Portfolio Recovery Associates, Inc. Portfolio Recovery Associates is a debt collector that purchases overdue consumer and business debts, including credit cards, medical debt, and other types of. Central Portfolio Control is a nationally licensed collection agency providing professional recovery services for our clients. Central Portfolio Control is a nationally licensed collection agency providing professional recovery services for our clients. Not sure how to fight debt collection agency? Watch this video and fill out the medial debt dispute document template, then send it to Portfolio Recovery. RANDALL, Judge. Pro se appellants Bradley and Karol Johnson challenge the district court's order granting summary judgment on their credit card debt. Pro Forma Financial Information. Not applicable c. Exhibits. Top of the Form. SIGNATURES. Pursuant to the requirements of the Securities Exchange Act of Leslie Mark Schneider, Hayt, Hayt & Landau, Miami, for Appellant. Paul Fernandes, Boca Raton, pro se. Circuit Court, 15th Judicial. pro rata basis among eligible Class Members who submit valid claims. Any remaining funds will be paid to the National Association of Consumer Advocates as. —[*1] Jared King, Coxsackie, appellant pro se. Malen & Associates, P.C., Westbury (Timothy J. Murtha of counsel), for respondent. Carpinello, J. Appeal from. VanLeeuwen appeals from a judgment granted against him and in favor of Plaintiff-Appellee, Portfolio Recovery Associates, LLC. VanLeeuwen appeals pro se, and. Pro Tips - Defending Debt Collection Lawsuits. Consumer Warrior · Will I Have to Pay the Debt Collector's Attorney's Fees? Consumer. Get more information for Portfolio Recovery Associates in Norfolk, VA If you want to work with your tax pro from home - just call and ask to use. The pro forma income taxes and pro forma net income information are unaudited. We believe that pro. Page forma net income for periods prior to may. Debt Collection, Portfolio Recovery Associates, LLC purchases unpaid debts from original creditors and works with consumers to recover these debts through. Portfolio Recovery Associates, Llc V. White, Courtney E. SEARCH TIPS pro per Prakash Narayan's (“Plaintiff”) motion to set aside the May 8, As an affiliate of Portfolio Recovery Associates LLC (PRA), they specialize in acquiring and collecting consumer debts. Resolving hurtful accounts from. Consumer Portfolio Services, Inc. is an independent specialty finance company that provides indirect automobile financing. The pro forma income taxes and pro forma net income information are unaudited. Equity Exchange Agreement between Portfolio Recovery Associates, L.L.C. and.

Cameco Corp Stock

The current price of CCJ is USD — it has increased by % in the past 24 hours. Watch Cameco Corporation stock price performance more closely on the. Cameco (CCO) Com NPV ; Trade low · CAD ; Year low · CAD ; Previous · CAD ; Volume · n/a ; Dividend yield · %. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding M; Public Float M; Beta On Friday, Cameco Corp (CJ6:FRA) closed at , % above the 52 week low of set on Aug 05, week range. Today. Aug 05 Cameco (CCO) Com NPV ; Trade low · CAD ; Year low · CAD ; Previous · CAD ; Volume · n/a ; Dividend yield · %. Cameco Corp. CCJ on Wednesday reported second-quarter earnings of $ million. The Saskatoon, Saskatchewan-based company said it had profit of 6 cents per. Stock Quote & Chart · TXS: CCO · NYSE: CCJ. Real-time Price Updates for Cameco Corp (CCO-T), along with buy or sell indicators, analysis, charts, historical performance, news and more. Discover real-time Cameco Corporation Common Stock (CCJ) stock prices, quotes, historical data, news, and Insights for informed trading and investment. The current price of CCJ is USD — it has increased by % in the past 24 hours. Watch Cameco Corporation stock price performance more closely on the. Cameco (CCO) Com NPV ; Trade low · CAD ; Year low · CAD ; Previous · CAD ; Volume · n/a ; Dividend yield · %. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding M; Public Float M; Beta On Friday, Cameco Corp (CJ6:FRA) closed at , % above the 52 week low of set on Aug 05, week range. Today. Aug 05 Cameco (CCO) Com NPV ; Trade low · CAD ; Year low · CAD ; Previous · CAD ; Volume · n/a ; Dividend yield · %. Cameco Corp. CCJ on Wednesday reported second-quarter earnings of $ million. The Saskatoon, Saskatchewan-based company said it had profit of 6 cents per. Stock Quote & Chart · TXS: CCO · NYSE: CCJ. Real-time Price Updates for Cameco Corp (CCO-T), along with buy or sell indicators, analysis, charts, historical performance, news and more. Discover real-time Cameco Corporation Common Stock (CCJ) stock prices, quotes, historical data, news, and Insights for informed trading and investment.

Cameco is one of the world's largest publicly traded uranium companies. Stock analysis for Cameco Corp (CCO:Toronto) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Valuation: Cameco Corporation ; P/E ratio * · EV / Sales * · Yield *. Cameco Corporation (NYSE:CCJ) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest changes in. Cameco Corp CCJ:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date05/31/24 · 52 Week Low · 52 Week. Valuation: Cameco Corporation ; P/E ratio * · EV / Sales * · Yield *. Cameco Corp is a provider of uranium needed to generate clean, reliable baseload electricity around the globe. VIX. % · Home CCJ • NYSE. add. Share. Cameco Corp. $ After Hours: $ (%) Closed: Aug 30, PM GMT-4 · USD · NYSE ·. On Tuesday morning 08/27/ the Cameco Corp. share started trading at the price of $ Compared to the closing price on Monday 08/26/ on BTT of $ Cameco Corporation provides uranium for the generation of electricity. It operates through Uranium, Fuel Services, Westinghouse segments. Cameco Corp. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - The average price target for Cameco Corp is C$ This is based on 8 Wall Streets Analysts month price targets, issued in the past 3 months. Get the latest updates on Cameco Corporation Common Stock (CCJ) pre market trades, share volumes, and more. Make informed investments with Nasdaq. CCO | Complete Cameco Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Cameco Corp. ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. Cameco Corp. engages in the provision of uranium. It operates through the Uranium and Fuel Services segments. Shares began trading on a split basis on December 29, on the Toronto Stock Exchange (TSX) and January 27, on the New York Stock Exchange (NYSE). Cameco Corp (CCJ) · Barchart Technical Opinion · Business Summary · CCJ Related ETFs · CCJ Related stocks · Key Turning Points. Cameco Corp (CCJ) ; 52 wk Range: ; Volume: 2,, ; Average Vol. (3m): 3,, ; 1-Year Change: % ; Fair Value. Unlock. Cameco Corp ; Previous Close: ; Open: ; Volume: 1,, ; 3 Month Average Trading Volume: ; Shares Out (Mil):

Business Loan Amortization

Use this tool to calculate the costs of a business loan and a monthly amortization schedule. Enter your loan information. Estimate Your Monthly Payment. See how affordable your repayments could be using our business loan calculator. New Calculator In Progress. How big of. Are you looking for capital for your business? If so, see what you'll pay and make the right decision with this business loan calculator! Independent Business & Agriculture Loan Calculator. Copy From First Scenario amortization (years). calculate. calculate. amortization schedule. *Above. The Business Loan Calculator calculates the payback amount and the total costs of a business loan. The calculator can also take the fees into account. Need to calculate your monthly payments for a potential business loan? Just use our handy (& easy) business loan calculator Amortization Period (years) Please. Amortization A method of debt repayment, in which fixed payments are made on a prearranged schedule. The payments are divided between principal and interest. For example, if you have a factor rate of on a loan of $10,, your business will pay back $13, — the original $10, and $3, in loan costs. This. Find out if you qualify for a business loan by entering the amount you want to borrow and other key inputs into the Citizens business loan calculator today. Use this tool to calculate the costs of a business loan and a monthly amortization schedule. Enter your loan information. Estimate Your Monthly Payment. See how affordable your repayments could be using our business loan calculator. New Calculator In Progress. How big of. Are you looking for capital for your business? If so, see what you'll pay and make the right decision with this business loan calculator! Independent Business & Agriculture Loan Calculator. Copy From First Scenario amortization (years). calculate. calculate. amortization schedule. *Above. The Business Loan Calculator calculates the payback amount and the total costs of a business loan. The calculator can also take the fees into account. Need to calculate your monthly payments for a potential business loan? Just use our handy (& easy) business loan calculator Amortization Period (years) Please. Amortization A method of debt repayment, in which fixed payments are made on a prearranged schedule. The payments are divided between principal and interest. For example, if you have a factor rate of on a loan of $10,, your business will pay back $13, — the original $10, and $3, in loan costs. This. Find out if you qualify for a business loan by entering the amount you want to borrow and other key inputs into the Citizens business loan calculator today.

amortizing, with the full principal amount due on December 31, Collection of CEBA Loans in Default. Loan Holders that do not repay their loan when due. Use our business loan calculator below to get an idea of how much a small business loan might cost you and to estimate your monthly payment. Looking for Business Loan Amortization Schedule Excel? OnDeck provides small business loans from $ to $ Financing available for up to 90% of the "Eligible Costs" of assets financed; Amortization on loans for equipment, leasehold improvements, intangible assets. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. Bankrate's business loan calculator can help you estimate what your loan will cost and how much you'll pay each month. Just enter a loan amount, loan term and. Terms of 1 to 4 years must have equal amortization. 4 Depending on your credit rating, some options may not be available and/or some conditions may apply. 5. With just a few simple questions, you'll be able to see how much that business loan will cost your company. Before you sign for the loan, use this calculator to. An amortization schedule is a table that outlines the scheduled payments for a loan, including the total amount paid, interest accrued, and the remaining. The amortization of a loan is the process in which monthly loan payments are made over time and the balance of the loan is slowly reduced. Term, Definition. Amortization is an accounting term that refers to the repayment of your loan principal over time. In the case of a small business loan, this means setting a. Business loans are generally amortised. A business loan amortisation table is a complete table showing the full schedule of repayments required for repaying the. This guide will explore how amortization works and learn how to calculate and create amortization schedules. In some cases, commercial lenders offer fully amortized loans as long as 20 or 25 years. This is how certain Small Business Administration loans are structured. Visit now to find out how much your monthly business loan payment will be based on the loan amount, interest rate and term of the loan. Terms to Know When Applying For a Commercial Real Estate Loan Amortization Period: A method of debt repayment, in which fixed payments are made on a. If you're looking to apply for a small business loan but aren't sure your budget can handle the repayments, our business loan calculator can help estimate. How it works is that the loan is amortized or spread out over a long period of time. With a balloon payment, the payments are generally interest-only or low-. Once contracted, an amortized individual mortgage repayment schedule is made available, outlining the entire decades-long repayment protocol. Payments are made. The SBA rate is set at the time of loan funding and is based on year treasury plus a spread. SBA term is 10, 20 or 25 years, fully amortized. 4 The.