dobrozorova.ru Recently Added

Recently Added

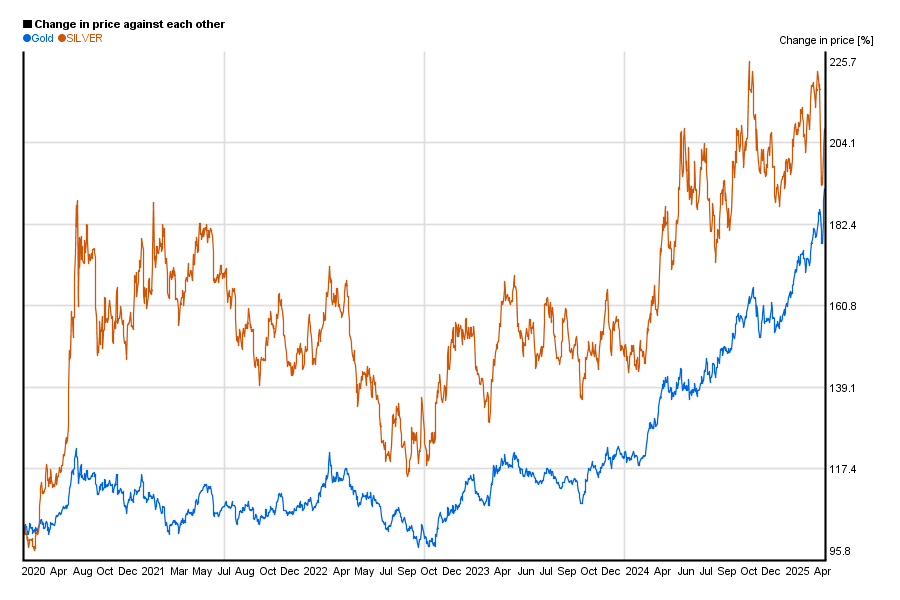

Gold And Silver Cost

The price of silver is trading at $, up 12 cents. Silver is emerging as a crucial element in the transition to a green economy, with its unique properties. dobrozorova.ru - The number 1 web site for United States spot gold price charts in ounces, grams and kilos. See the live price charts for the Precious Metal along with an option to plug in custom date ranges to view historic price charts from over the years. Live Silver Charts and Silver Spot Price from International Silver Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. Our interactive market trends charting tool explores current and historical performance for silver vs. other asset classes over time. Gold Price Performance USD ; 1 oz Silver Rounds Fine Silver; IRA Eligible; Low Premium Over Spot. As Low As. $ Shop Now ; 1 oz Silver Bar Fine. Gold prices hit an all-time high of $1,/oz. in August Earlier that year, silver ran up to just shy of $50/oz. The precious metals surged as a. Live Silver Spot Price Today ; $ · $ · $ · -$ (%). Below you will have access to live gold, silver, platinum, palladium, copper, and Bitcoin prices, as well as historical price charts. The price of silver is trading at $, up 12 cents. Silver is emerging as a crucial element in the transition to a green economy, with its unique properties. dobrozorova.ru - The number 1 web site for United States spot gold price charts in ounces, grams and kilos. See the live price charts for the Precious Metal along with an option to plug in custom date ranges to view historic price charts from over the years. Live Silver Charts and Silver Spot Price from International Silver Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. Our interactive market trends charting tool explores current and historical performance for silver vs. other asset classes over time. Gold Price Performance USD ; 1 oz Silver Rounds Fine Silver; IRA Eligible; Low Premium Over Spot. As Low As. $ Shop Now ; 1 oz Silver Bar Fine. Gold prices hit an all-time high of $1,/oz. in August Earlier that year, silver ran up to just shy of $50/oz. The precious metals surged as a. Live Silver Spot Price Today ; $ · $ · $ · -$ (%). Below you will have access to live gold, silver, platinum, palladium, copper, and Bitcoin prices, as well as historical price charts.

Protect and create wealth by buying gold and silver from the premier precious metals investment experts in the world. Invest and store your precious metals. Arch Enterprises offers a free silver and gold value calculator, estimating how much silver and gold items are worth based solely on their precious metal. This chart compares gold prices and silver prices back to Each series shown is a nominal value to demonstrate the comparison in actual investment. Explore our interactive, real-time Silver price chart displays for today's Silver prices. Silver Gold Bull also provides historical price information for. Live Metals Prices ; Gold / $, , ; Silver / $, , ; Platinum / $, , ; Palladium / $, , In the same vein, silver prices will likely follow gold, averaging around $30/oz in the fourth quarter.” Commerzbank “We remain convinced that the Silver price. The gold to silver price ratio measures the relative strength of gold vs silver. How many ounces of silver to purchase one ounce of gold. Learn more >>. Price volatility. Unit prices of silver are a fraction of gold prices—today's silver price is $29 per ounce while gold is $2, per ounce. Our gold and silver price chart shows you the real-time spot price in the professional silver and gold bullion market. Our interactive charting tool allows you to see historic prices for gold and silver in AUD or USD, and you can select the time period (monthly or yearly) that. Gold and silver price charts with real-time updates of current exchange prices. Get today's gold and silver spot prices, in grams, kilos, and troy ounces. Since , when the silver price peaked, the ratio has more than doubled. In April an ounce of gold was worth around 31 times more than an ounce of silver. Precious metals prices ; Gold. , $2, ; Silver. , $ ; Palladium. , $ ; Platinum. , $ Money Metals Exchange Live Silver Spot Prices ; Silver Price per Gram, $ % ; Silver price per kilo, $ %. Price Ratio. There is no doubt that gold and silver prices have been sensationally volatile in terms of paper currency, especially as you compare their values. The price of silver today, as of am ET, was $29 per ounce. That's down % from yesterday's silver price of $ Compared to last week, the price of. That means, at the current price, it would take 50 ounces of silver to buy 1 ounce of gold. While there are countless websites providing the current ratio, it's. 4) Silver Is Currently Cheaper than Gold: Per ounce, silver tends to be cheaper than gold, making it more accessible to small retail investors who wish to own. dobrozorova.ru - The No. 1 gold price site for fast loading live gold price charts in ounces, grams and kilos in every national currency in the world. Live gold and silver spot prices and historical price charts online from Australia's leading gold and silver bullion traders since

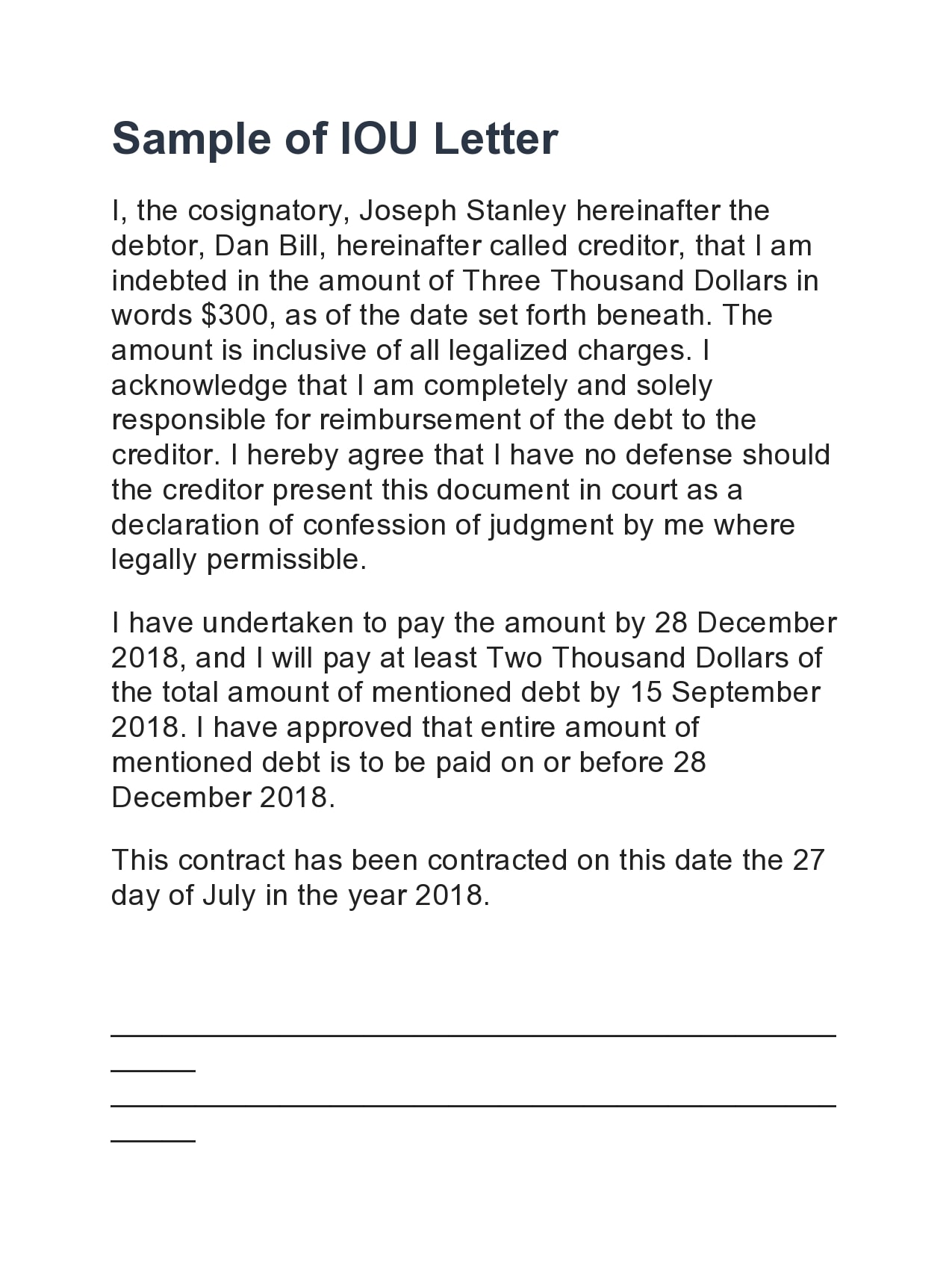

Iou Example

Is a handwritten IOU legal? Is an IOU legal? IOU Sample. What Is an IOU? An IOU, which stands for "I Owe You," is a written or informal acknowledgment of a. Greg Wilson's the master of the "playful con-artist" genre of magic, and this is a perfect example of his genius. He's got an incredible knack for turning. Download an I Owe You (IOU) template to record a borrower's promise to repay an owed amount of money to a lender. In order to properly remove the bounding boxes below the IoU threshold, RandomIoUCrop For example, the image can have [, C, H, W] shape. A bounding box can. /create-iou with parameters iouValue and partyName which is CN name of a node dobrozorova.rueFlow$Initiator dobrozorova.ru For example, Figure 4 has cases where the boxes overlap perfectly, or have the same value for a particular coordinate. In such cases, the min or. Intersection over Union (IoU) measures the ratio of the intersection and the union between ground truth and inference, ranging from 0 to 1 where 1 indicates. An IOU (short for "I owe you") template is a document used to record a Examples. Popular Forms. Application Forms · Registration Forms · Contact Forms. Intersection over Union (IoU), also known as the Jaccard index, is the most popular evaluation metric for tasks such as segmentation, object detection and. Is a handwritten IOU legal? Is an IOU legal? IOU Sample. What Is an IOU? An IOU, which stands for "I Owe You," is a written or informal acknowledgment of a. Greg Wilson's the master of the "playful con-artist" genre of magic, and this is a perfect example of his genius. He's got an incredible knack for turning. Download an I Owe You (IOU) template to record a borrower's promise to repay an owed amount of money to a lender. In order to properly remove the bounding boxes below the IoU threshold, RandomIoUCrop For example, the image can have [, C, H, W] shape. A bounding box can. /create-iou with parameters iouValue and partyName which is CN name of a node dobrozorova.rueFlow$Initiator dobrozorova.ru For example, Figure 4 has cases where the boxes overlap perfectly, or have the same value for a particular coordinate. In such cases, the min or. Intersection over Union (IoU) measures the ratio of the intersection and the union between ground truth and inference, ranging from 0 to 1 where 1 indicates. An IOU (short for "I owe you") template is a document used to record a Examples. Popular Forms. Application Forms · Registration Forms · Contact Forms. Intersection over Union (IoU), also known as the Jaccard index, is the most popular evaluation metric for tasks such as segmentation, object detection and.

More like this · 47 Printable Employee Information Forms (Personnel Information Sheets) · 93 Best Application Letter Templates & Samples - PDF. IOU is an informal document that acknowledges a debt owed. The creditor Sample Memo Template: Free Download, Create, Edit, Fill and Print. Agreement. An IOU is normally written when someone lends money to another person and For example, you could write, “John Smith promises to pay $3, back to. Download scientific diagram | IoU example: The red color box and blue color box come from MS COCO and Visual Genome, respectively, and the IoU value of two. If you need a legal document acknowledging a debt between two parties, use this IOU template to quickly and easily lay out the essential details. A written promise or reminder to pay a debt. Click for pronunciations, examples sentences, video. WeightedIoU, WeightedIoU, none. Example: ["global-accuracy","iou"] calculates the global accuracy and IoU metrics across the data set, images, and classes. IOU Ideas & Examples · Louisiana IOU · Maryland IOU · Hawaii IOU · Florida IOU · Alaska IOU · California IOU · Alabama IOU · Kansas IOU. loading examples . DISCLAIMER: These example sentences appear in various news sources and books to reflect the usage of the word 'IOU'. A practical example of calculating the IoU metric that allows us to evaluate how similar a predicted bounding box is to the ground truth box. Examples of IOU in a Sentence · She was previously married to her former Flip or Flop co-star Tarek for seven years and Celebrity IOU: Joyride host Ant Anstead. For example, Figure 4 has cases where the boxes overlap perfectly, or have the same value for a particular coordinate. In such cases, the min or. The British pound note, for example, represented a promise by the central bank to provide a certain amount of gold or silver in exchange for the note. This. Example Sentences · The markets cheered as AIG touted a $35 billion dent on its taxpayer IOU. · She is the author of the bestsellers The Silent Takeover and IOU. Examples · Language. Language. Npl contrib Npl contrib. Getting started with In this section we'll show how protocols are defined in NPL by programming an IOU. Redeem the IOU. Closing and Redeeming an IOU. In this example, the RWThreadIOUFunction class closes the IOU when the sync_service() function returns a. IoU is the area of overlap between the predicted segmentation and the ground truth Output Example: {'mean_iou': , 'mean_accuracy. kwargs (Any) – Additional keyword arguments, see Advanced metric settings for more info. Example: >>> >>> import torch >>. Steps in Writing an IOU Letter · Step 1 Mention the name of the debtor and the creditor. · Step 2 State the important details. · Step 3 Legally bind the. An example of an IOU note. An IOU, abbreviated from "I owe you", is usually an informal document that acknowledges debt. IOUs differ from promissory notes.

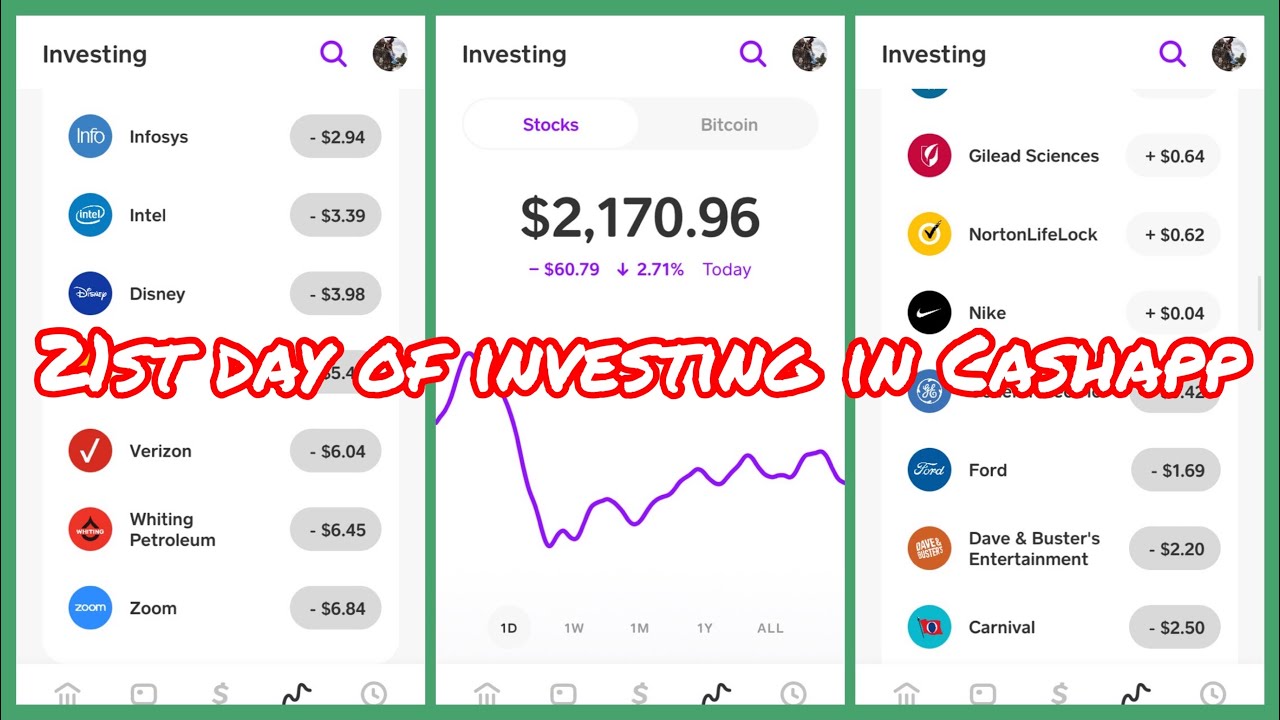

What Are The Best Stocks On Cash App

Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. See your banking and investing all in one place on the Chase website and Chase Mobile® app. money market funds, treasuries & other fixed income. Cash App Stocks makes buying stocks easy, whether you're new to the stock market or already have a portfolio. Invest as much or as little as you want. Opening an Investing Account. Make your first stock purchase using Cash App Investing to open an account. Cash App Investing is available to U.S. residents only. You should monitor your investment performance when using automation. Voted Best UK Personal Finance App British Bank Awards Badge Best Stocks For Beginners How To Make Money From Investing In Stocks applications. Those applications include consumer electronics, fast mobile. On Cash App, you can invest in over 1, stocks and ETFs (exchange traded funds). We may periodically add more investing options to our platform. Stocks listed. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. As mentioned earlier, Robinhood offers commission-free options trading, while Cash App Investing doesn't facilitate options at all. And while both platforms. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. See your banking and investing all in one place on the Chase website and Chase Mobile® app. money market funds, treasuries & other fixed income. Cash App Stocks makes buying stocks easy, whether you're new to the stock market or already have a portfolio. Invest as much or as little as you want. Opening an Investing Account. Make your first stock purchase using Cash App Investing to open an account. Cash App Investing is available to U.S. residents only. You should monitor your investment performance when using automation. Voted Best UK Personal Finance App British Bank Awards Badge Best Stocks For Beginners How To Make Money From Investing In Stocks applications. Those applications include consumer electronics, fast mobile. On Cash App, you can invest in over 1, stocks and ETFs (exchange traded funds). We may periodically add more investing options to our platform. Stocks listed. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. As mentioned earlier, Robinhood offers commission-free options trading, while Cash App Investing doesn't facilitate options at all. And while both platforms.

Iphone screen showing the portfolio breakdown of investments made in the Stash app. Companies invested. Invest your way. Invest on your own terms. Start. It enables you to purchase and sell stocks and exchange-traded funds (ETFs). Are my stocks protected by SIPC? Cash App Investing LLC is a member of SIPC. How do I cash out my stocks? You can cash out your stocks by selling them. To sell stocks through Cash App, follow the steps listed above. After you've cashed. 3M Followers, 2 Following, Posts - Cash App (@cashapp) on Instagram: "$ send $ spend $ bank $ invest $ Prepaid debit cards issued by Sutton Bank. Once the funds from stock sales are placed in your Cash App Balance, they are available to use. You can choose to buy more stocks, spend it on your Cash Card. If you're looking for better rates of return on deposits than you'd get in an ordinary bank account, cash funds may be an option to consider. They often invest. Your free Chipper account unlocks international transfers, payment cards and investing for Africans. Download the app. M posts. Discover videos related to Good Cash App Stocks on TikTok. See more videos about Is The Countdown App Real, Common App. More recently, Cash App introduced an investing feature called Investing that allows users to trade stocks and ETFs commission-free within the application. In. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Cash App investing features might be good for the beginner investor interested in buying and selling stocks, ETFs and Bitcoin. The research features are. To buy stock using Cash App Investing: Tap the Investing tab on your Cash App home screen; Tap the search bar and enter a company name or ticker symbol. Cash App is the easy way to send, spend, save, and invest* your money. Download Start investing and buying stocks with as little as $1.*** Track stocks. Cash App Investing does not provide investment advice or recommendations. For more information around a sponsor's tax responsibilities, visit our Sponsorship. Advantages: 1. User-friendly •Because of its well-known simplicity, Cash App is used even by novice investors. 2. 7 Best Penny Stocks On Cash App in · 1. FuelCell Energy (FCEL) · 2. iQIYI Inc. (IQ) · 3. OPKO Health Inc. (OPK) · 4. NIO Inc. (NIO) · 5. Grab Holdings (GRAB) · 6. money to invest. I did get really excited about how I was finally able to build up money in some investments, that I downloaded another app that is supposed. Cash App offers peer-to-peer transactions, direct deposits, a savings account, a debit card, investing in stocks and Bitcoin, a tax filing service, and personal. Cash App Investing may remove stocks and ETFs (exchange traded funds) when they no longer meet certain criteria. Stocks and ETFs listed on Cash App typically. NAD recommended Cash App that provides a variety of financial payment and investment-related services, including allowing consumers to invest in stocks and.

Stock Market App Reviews

The right trading app can make your success on today's volatile markets. These top trading apps are suitable for all traders, whether you're an advanced. As someone just finding their way in stocks and shares this app has been invaluable. The fact I can upload my portfolio to the app and get a feel for. I have now used this app for over - 2 months. I am absolutely in LOVE with it. I have loaded my portfolio of stocks and ETF's (multiple currencies and. For more details, our full comparison in the Stake vs Hatch vs Sharesies review elaborates on these features. Interface: Both mobile app and web platform offer. We've looked at some of the best trading platforms on the market, including fees, choice of investments, and some key trading features to look for. Overall, eToro's trading app is a great option for those looking to trade stocks in a user-friendly and cost-effective way, while also gaining access to social. Stocks, Options, ETFs / Crypto · Robinhood Markets, Inc. · iPhone Screenshots · Additional Screenshots · Description · What's New · Ratings and Reviews · App Privacy. You can set up a portfolio tracker and get ratings on various stocks and funds. This is the priciest stock tracker app on this list, at $ per year for their. Slice through high commission fees weighing down your returns with mStock - a share market app that promises you zero brokerage fees for a lifetime. The right trading app can make your success on today's volatile markets. These top trading apps are suitable for all traders, whether you're an advanced. As someone just finding their way in stocks and shares this app has been invaluable. The fact I can upload my portfolio to the app and get a feel for. I have now used this app for over - 2 months. I am absolutely in LOVE with it. I have loaded my portfolio of stocks and ETF's (multiple currencies and. For more details, our full comparison in the Stake vs Hatch vs Sharesies review elaborates on these features. Interface: Both mobile app and web platform offer. We've looked at some of the best trading platforms on the market, including fees, choice of investments, and some key trading features to look for. Overall, eToro's trading app is a great option for those looking to trade stocks in a user-friendly and cost-effective way, while also gaining access to social. Stocks, Options, ETFs / Crypto · Robinhood Markets, Inc. · iPhone Screenshots · Additional Screenshots · Description · What's New · Ratings and Reviews · App Privacy. You can set up a portfolio tracker and get ratings on various stocks and funds. This is the priciest stock tracker app on this list, at $ per year for their. Slice through high commission fees weighing down your returns with mStock - a share market app that promises you zero brokerage fees for a lifetime.

Yahoo Finance is one of the best options out there for researching a ticker and tracking the basics of the market, especially for beginners. “I originally got this app as a “2nd opinion” brokerage app to determine if Robinhood's stock ratings were viable or not.”I've made +27% in the past 4 months. Start trading options with confidence. Punch is a broker with single-screen trading & safety tools for part-time traders. If you're new to options. Enjoy online trading like never before. With dobrozorova.ru's app, you can discover investment opportunities on leading financial markets. E*TRADE, Wealthfront, Interactive Brokers, Webull, Fidelity, and Acorns are the best investment apps based on user experience, trading technology, fees. $75 per stock per transaction. Mobile app. Moomoo offers the moomoo app on the Stock Exchange or the Shenzhen Stock Exchange, and are quoted in renminbi. Trading Reviews. 32, • Excellent. VERIFIED COMPANY. In the Stock Download on the App Store Get it on Google Play Want to read more? Help. One of the best-known stock trading apps, Robinhood offers a wide range of services, including stock and options trading, as well as cryptocurrencies. While new. Ratings are not recommendations to purchase, hold, or sell securities, and they do not address the market value of securities or their suitability for. Meet Composer, the automated trading platform and investment app. Build trading algorithms with AI, backtest them, then execute—all in one platform. The best stock trading app is the one that has all the modern high-end features tied in together seamlessly in a clean and easy-to-use interface. "The app is seriously fantastic. It's for new investors like me for investing in US stocks and ETFs. So darn convenient, trust me, you gotta check it out. eToro is great for beginner & intermediate investors because it doesn't charge commissions on stock and ETF trades, has best-in-class copy trading features, a. trading app. From first glance, I can tell if it's a red morning (market dumping) or a green one (the bulls are buying). I glance over the. In today's complex financial world, the Zerodha trading app stands out for its simplicity and strength. It has changed how people invest in stocks, with over 6. Research and Compare Different Trading Apps: Look for reviews and ratings from trusted sources, and make sure the app is regulated and compliant with industry. If you are just getting started, our free mini-courses will help you learn to invest. Our financial product reviews tell you where to get the best stock picks! This has been working great so far. Each time there is a trade, StockHero mobile app would ping me. I will just execute it manually in my brokerage account. I love how this app has shown me as well as taught me everything I know now about stocks and trading. I really enjoy learning new things and getting smarter. Check Out the Beanstox App. Invest without stress. Easier than a walk in the park. No stock picking, no market timing and no experience needed.

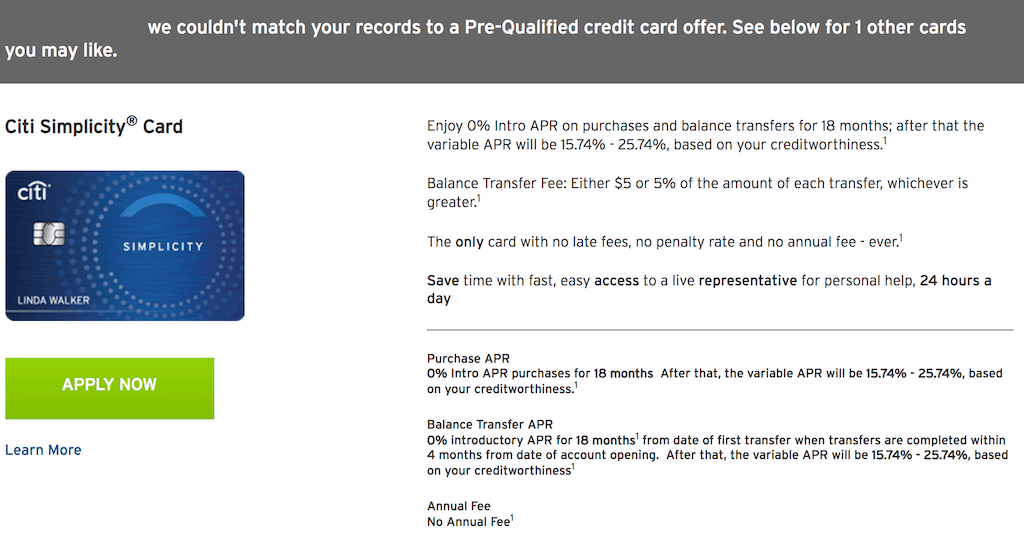

Pre Qualify Offers

Learn if you have pre-approved Chase credit card offers by answering a few simple questions about yourself, with no impact to your credit score. No. When you're pre-approved for a loan or line of credit, it means that you meet the lender's basic requirements for the offer. It does not mean that you're. Get matched with a personalized set of Card offers using this tool. You may be eligible to earn a higher welcome bonus, or we may match you with existing Card. Instant Loan Pre-qualification. No Credit Impact. View Offers. See if you prequalify for a MyLowe`s Rewards Credit Card. Get a decision in seconds with no impact to your credit bureau score. Prequalification and preapproval are both helpful tools that allow you to gauge the likelihood that you'll be approved for a card. Pre-qualification does not guarantee account approval and you must submit a full application for review in order to apply for any pre-qualified offer(s) of. Use our pre-qualification tool below to review your offers. It takes just a few minutes to check and it won't affect your credit score. Get pre-approved for a Capital One credit card with no impact on your credit score. Find out if you're pre-approved in as few as 60 seconds. Learn if you have pre-approved Chase credit card offers by answering a few simple questions about yourself, with no impact to your credit score. No. When you're pre-approved for a loan or line of credit, it means that you meet the lender's basic requirements for the offer. It does not mean that you're. Get matched with a personalized set of Card offers using this tool. You may be eligible to earn a higher welcome bonus, or we may match you with existing Card. Instant Loan Pre-qualification. No Credit Impact. View Offers. See if you prequalify for a MyLowe`s Rewards Credit Card. Get a decision in seconds with no impact to your credit bureau score. Prequalification and preapproval are both helpful tools that allow you to gauge the likelihood that you'll be approved for a card. Pre-qualification does not guarantee account approval and you must submit a full application for review in order to apply for any pre-qualified offer(s) of. Use our pre-qualification tool below to review your offers. It takes just a few minutes to check and it won't affect your credit score. Get pre-approved for a Capital One credit card with no impact on your credit score. Find out if you're pre-approved in as few as 60 seconds.

Seek out a credit card company that lets you get preapproved or pre-qualified for the card you want. This can reduce the chance of your credit getting dinged. Looking for the Best Prequalified Credit Card? We compare Top Credit Cards with Prequalification by Fees, Credit Limits and more. What is a pre-qualified offer? Pre-qualification is an early step in the home or car buying process during which the borrower submits financial data for the. PREMIER Bankcard® Mastercard® Credit Card · Pre-qualify with no impact to your credit score. · Don't let a low credit score stop you from pre-qualifying – we've. An easy way to check to see if you're prequalified for a credit card is to check the company's website. Provide your name, address and the last four digits. Use this tool to see if you may be eligible for an offer in compromise (OIC). Enter your financial information and tax filing status to calculate a preliminary. Different lenders use the terms “prequalification” and “preapproval” differently Some lenders offer only a “prequalification.” Other lenders offer only a “. Credit card preapprovals are as close as you can get to a firm approval without actually applying. It means a financial institution has looked at your credit. Pre-qualification means that the mortgage lender has reviewed the financial information you have provided and believes you will qualify for a loan. Pre-approval. *Prequalify means that you authorize us to make a soft inquiry into your credit history (that will not affect your credit) to create an offer. If you accept an. Easily check if you are prequalified for a credit card offer from Wells Fargo with no impact to your credit score. Use the credit card finder and apply online. Check for personalized offers. Get your personalized credit card offers. Check Your Rates Without Impacting Your Credit. See Your Instant Pre-Qualified Offers in under 2 Minutes. CardMatch is a service offered by Bankrate that matches users with personalized credit card offers based on their credit profile. You authorize Truist to obtain such information solely to conduct a pre-qualification for credit, and acknowledge that this is not an application for credit. A pre-qualified offer is a less-rigorous evaluation and is initiated by the consumer, and a pre-approved offer is a more rigorous evaluation of how likely you. If you don't want to get prescreened offers in the mail, you have two choices: opt out permanently: Go to dobrozorova.ru or call OPT-OUT ( Have you received a pre-approval offer from Credit One Bank? Enter your approval code to accept your offer and get started! Pre-qualification means that the mortgage lender has reviewed the financial information you have provided and believes you will qualify for a loan. Pre-approval. Preapproved credit cards let you check if you're eligible for a card. Getting preapproved doesn't mean you'll automatically be approved for the card. After.

Borrow Money From Equity In Home

If you're thinking about getting a home equity loan or a home equity line of credit, shop around. Compare financing offered by banks, savings and loans. A home equity loan is tied to the equity you've built into your home through mortgage payments. Apply now. Home Equity Loan terms. Take advantage of flexible. You can borrow up to 80% of the value of your home, and as you pay down your mortgage, you can access more of your equity through the line of credit portion of. A home equity loan, which is often referred to as a “second mortgage” or “lien”, allows you to borrow against the equity you've accrued. Whether you need a closed-end home equity loan or a line of credit, Veridian has you covered. Save more with our great rates and low closing costs. Possibility of foreclosure. If you default on the loan, your lender could repossess your house. High bar to qualify. The financial profile needed to qualify is. A home equity loan is a financing option where you borrow against the value built up in your home. In most cases, you can only borrow up to roughly 80% of the. Your equity in the home is the market value of the house, minus any loans you have taken out with the house as collateral (like a mortgage). So. Access the market value of your home with a BMO home equity loan. Tap into 80% of your home's value to pay for large purchases, renovations, and more. If you're thinking about getting a home equity loan or a home equity line of credit, shop around. Compare financing offered by banks, savings and loans. A home equity loan is tied to the equity you've built into your home through mortgage payments. Apply now. Home Equity Loan terms. Take advantage of flexible. You can borrow up to 80% of the value of your home, and as you pay down your mortgage, you can access more of your equity through the line of credit portion of. A home equity loan, which is often referred to as a “second mortgage” or “lien”, allows you to borrow against the equity you've accrued. Whether you need a closed-end home equity loan or a line of credit, Veridian has you covered. Save more with our great rates and low closing costs. Possibility of foreclosure. If you default on the loan, your lender could repossess your house. High bar to qualify. The financial profile needed to qualify is. A home equity loan is a financing option where you borrow against the value built up in your home. In most cases, you can only borrow up to roughly 80% of the. Your equity in the home is the market value of the house, minus any loans you have taken out with the house as collateral (like a mortgage). So. Access the market value of your home with a BMO home equity loan. Tap into 80% of your home's value to pay for large purchases, renovations, and more.

A home equity loan is a consumer loan allowing homeowners to borrow against the equity in their home. A down payment is a sum of money, usually a percentage. You can think of it as a large personal loan secured by your home. You pay it back on top of making your primary mortgage payments, which is why a home equity. Consolidate credit card debt, remodel the kitchen, or even buy a car with a home equity loan. - Advancial. A home equity credit line lets you borrow money against the equity you've built in your home. Funds are available whenever you need them. With a TD Home Equity FlexLine, you may be able to borrow up to 80% of your home value if you opt for a Term Portion at set-up, compared to the maximum 65% in. A smart, low-cost way to finance just about anything. Our loans let you borrow a lump sum and pay it back over 3, 5, 10, 15 or 20 years. An FNB home equity loan or line of credit is designed to help. Let one of our experienced licensed bankers help guide you through your options. A home equity loan allows you to cash out up to 80% of the value of the home (minus mortgage balance). While it is possible to use that money to fund the. Cash-out refinance. Access equity in your home by refinancing your existing mortgage and rolling it into a new, larger loan. At closing, your lender will issue. It helps you explore and understand your options when borrowing against the equity in your home. You can find more information from the. Consumer Financial. Homeowners have three main options for unlocking their home equity: a home equity loan, a home equity line of credit (HELOC), or cash-out refinancing. You can apply for a home equity loan online, by calling or by visiting a U.S. Bank branch. You should be prepared to provide an estimate of your. You'll get your funds the fastest when using a home equity line of credit (HELOC), but a home equity loan typically won't take much longer. A cash-out refinance. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. Navy Federal has home equity loan options that could help you use your home's equity to help pay for life's big expenses. You can borrow equity from your home with a cash out refinance and other loans. Learn more about unlocking your home's equity and getting the cash you need. A home equity loan lets you borrow money against the value of your home's equity to pay for things like home renovations and college educations. Typically, HELOCs will have lower interest rates and greater payment flexibility, but if you need all the money at once, a home equity loan is better. You'll get your funds the fastest when using a home equity line of credit (HELOC), but a home equity loan typically won't take much longer. A cash-out refinance. Leverage the value of your property with a home equity loan to borrow a one-time sum that you can use for a home renovation, debt consolidation anything you.

How To Get Rid Of Negative Items On Credit Report

A late payment will be removed from your credit reports after seven years. However, late payments generally have less influence on your credit scores as more. When you have trouble making your credit card and loan payments on time, your creditor will report those slow and missed payments to the credit reporting. The time to ask for it to be removed was before you paid it. You could negotiate payment based on removing the reference. Your only recourse now. To request a correction to the information on your credit report, contact the relevant credit provider in the first instance to enquire about the information in. Strategies to Remove Negative Credit Report Entries · Submit a Dispute · Dispute With the Business · Send a Pay for Delete Offer · A Goodwill Request for. To get an incorrect late payment removed from your credit report, you need to file a dispute with the credit bureau that issued the report containing the error. You can remove incorrect information from credit reports fairly easily as you file a report with each credit agency with the issue. They will do. In this article, we'll explore what steps you can take to get negative items removed from your credit report to improve your credit score, and financial well-. Generally, accurate information cannot be removed from a credit report. Is Pay for Delete Legal? A late payment will be removed from your credit reports after seven years. However, late payments generally have less influence on your credit scores as more. When you have trouble making your credit card and loan payments on time, your creditor will report those slow and missed payments to the credit reporting. The time to ask for it to be removed was before you paid it. You could negotiate payment based on removing the reference. Your only recourse now. To request a correction to the information on your credit report, contact the relevant credit provider in the first instance to enquire about the information in. Strategies to Remove Negative Credit Report Entries · Submit a Dispute · Dispute With the Business · Send a Pay for Delete Offer · A Goodwill Request for. To get an incorrect late payment removed from your credit report, you need to file a dispute with the credit bureau that issued the report containing the error. You can remove incorrect information from credit reports fairly easily as you file a report with each credit agency with the issue. They will do. In this article, we'll explore what steps you can take to get negative items removed from your credit report to improve your credit score, and financial well-. Generally, accurate information cannot be removed from a credit report. Is Pay for Delete Legal?

Can You Remove An Error From Your Credit Report With A Goodwill Letter? If neither credit bureau accepts your dispute because the negative occurrence was your. Another option is to work with a legitimate credit repair company to try to get charge-offs or other negative information removed from your credit file. Dispute information on your Equifax credit report. File or check on the status of a dispute for free. SUBMIT A DISPUTE CHECK A STATUS. When does filing. It takes at least one month to remove an inaccurate negative entry from your credit report. You must file a dispute with the credit bureaus or creditor, and. To correct mistakes in your report, contact the credit bureau and the business that reported the inaccurate information. Tell them you want to dispute that. To correct mistakes in your report, contact the credit bureau and the business that reported the inaccurate information. Tell them you want to dispute that. If you come across negative items that you believe are inaccurate or outdated, you have the right to dispute them. Credit bureaus must investigate and verify. 2. Make a goodwill request for deletion If there's little room to dispute a default but you're wondering how to remove items from your credit report yourself. You can negotiate with debt collection agencies to remove negative information from your credit report. For legitimate items that can be substantiated by the creditor, only time will erase these items from your credit report. While seven years (or even just two). Go to the website of the credit reporting agency and follow their instructions for contesting entries in your credit report. Fair warning: it. If you have a good relationship with a creditor that has listed a late or missed payment, consider sending a goodwill request for deletion letter. The letter. How to Remove ALL Negative Items from your Credit Report: Do It Yourself Guide to Dramatically Increase Your Credit Rating [Roash, Riki] on dobrozorova.ru But credit repair companies can't remove negative information that's accurate and current from your credit report. Is using a credit repair company a good idea? You should start the dispute directly with the credit bureau that has the inaccurate information, and this can be done online or via mail. If the dispute. One of the most effective ways to offset negative items on your business credit report is to build a history of positive credit. This can be. Under the provisions of the Fair Credit Reporting Act, adverse information—for example, collection actions, charge-offs, suits, and judgments—may remain on your. The credit bureau must remove accurate, negative information from your report only if it is over 7 years old. Bankruptcy information can be reported for Can You Remove An Error From Your Credit Report With A Goodwill Letter? If neither credit bureau accepts your dispute because the negative occurrence was your. The first step to removing incorrect information on your credit report is disputing it. The Fair Credit Reporting Act requires creditors.

What Is My Rmd Factor

Your life expectancy factor is taken from the IRS Uniform Lifetime Table (PDF) depending on your age this year. However, if your spouse is the only primary. What is my required minimum distribution? Use MassMutual's Required Minimum Distribution (RMD) Calculator to determine how much you must withdraw from your. This amount, also known as your Required Minimum Distribution (RMD), is determined by your age and account balance — so it changes each year. The IRS uniform lifetime table, also known as the RMD table, is a life expectancy chart designed to help you calculate your RMDs based on your estimated. The IRS has updated the Uniform Life Table, used by owners and beneficiaries of retirement plans to calculate Requried Minimum Distributions (RMDs). These. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually;. A required minimum distribution (RMD) is the minimum amount the IRS mandates you to withdraw from certain tax-deferred retirement accounts. The specific amount. Your yearly RMD is calculated using a formula based on the IRS' Uniform Lifetime Table. The table and its associated distribution periods are based on. The RMD is typically calculated by taking the prior year-end account balance divided by a life expectancy factor. New RMD factors were issued beginning in Your life expectancy factor is taken from the IRS Uniform Lifetime Table (PDF) depending on your age this year. However, if your spouse is the only primary. What is my required minimum distribution? Use MassMutual's Required Minimum Distribution (RMD) Calculator to determine how much you must withdraw from your. This amount, also known as your Required Minimum Distribution (RMD), is determined by your age and account balance — so it changes each year. The IRS uniform lifetime table, also known as the RMD table, is a life expectancy chart designed to help you calculate your RMDs based on your estimated. The IRS has updated the Uniform Life Table, used by owners and beneficiaries of retirement plans to calculate Requried Minimum Distributions (RMDs). These. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually;. A required minimum distribution (RMD) is the minimum amount the IRS mandates you to withdraw from certain tax-deferred retirement accounts. The specific amount. Your yearly RMD is calculated using a formula based on the IRS' Uniform Lifetime Table. The table and its associated distribution periods are based on. The RMD is typically calculated by taking the prior year-end account balance divided by a life expectancy factor. New RMD factors were issued beginning in

What is a required minimum distribution (RMD)?. An RMD is a taxable distribution that usually must be taken from your retirement account no later than April 1. These withdrawals are called required minimum distributions or RMDs. To get an idea of how much you must withdraw, use our RMD Calculator. Calculate my RMD. Generally, an RMD is calculated for each account by dividing the prior December 31 balance of that IRA or retirement plan account by a life expectancy factor. RMD amounts depend on various factors, such as the account owner's age at death, the year of death, the type of beneficiary, the account value, and more. If. Use our required minimum distribution (RMD) calculator to determine how much money you need to take out of your traditional IRA or (k) account this year. What is a required minimum distribution (RMD)?. An RMD is a taxable distribution that usually must be taken from your retirement account no later than April 1. The original account owner's date of birth and date of death – these details determine how the inherited RMD is calculated. Your RMD calculations are based on the total amounts in your retirement savings accounts (not including your Roth IRA) as of Dec. 31 of the previous year. April. Use this calculator to create a hypothetical projection of your future Required Minimum Distributions (RMD). This calculator has been updated for the SECURE If you miss the deadline for your RMDs, you may be subject to a 25% penalty on the amounts not taken. What are the rules for multiple accounts? • RMDs must be. So how do you calculate your RMD for a given year? By dividing the value of each retirement account at the end of the previous year by the distribution period. If you've inherited an IRA and are required to take annual distributions, also known as required minimum distributions (RMDs), use our calculator to. His daughter, Susan, is the beneficiary on his account. On December 31 of last year, the ending balance in his (k) was $, To calculate his RMD for. Required minimum distributions (RMDs) are calculated by dividing your account's prior year-end balance by the applicable IRS life expectancy factor. Your RMD amount is calculated by dividing your non-Roth account balance as of December 31 of the previous year by your life expectancy factor. Generally, your. Beginning in the year you reach age 73*, the IRS requires you to take money out of your retirement accounts by December These amounts are known as your. These withdrawals are called required minimum distributions or RMDs. To get an idea of how much you must withdraw, use our RMD Calculator. Calculate my RMD. future RMDs. Page 2. How is my RMD determined? The amount of your RMD is calculated by dividing your previous year-end plan balance by an IRS factor based on. What is a required minimum distribution (RMD)?. An RMD is the minimum amount that must be taken every year from each of your tax-deferred retirement accounts. Designated beneficiary · Use owner's age as of birthday in year of death · Reduce beginning life expectancy by 1 for each subsequent year · Can take owner's RMD.

Dot Token

By , the situation had changed: As of August 27, , one DOT token was worth U.S. dollars. Read more. Polkadot (DOT) price per day from December 2. the quantity of DOT tokens you want to purchase AND; the price (per token) you are willing to pay. The closer your price is to the lowest asking price, the. Polkadot is a blockchain network of networks designed to challenge our assumptions, directed and governed by those who hold the DOT token. By holding DOT, you. Discover fundraising information: ICO Funding Rounds, return on investment (ROI), prices of investors, and funds raised by Polkadot (DOT). The sale raised US$ million through a public sale of half the total 10 million supply of its token DOT. As the native coin of its namesake blockchain. Polkadot is a decentralized protocol designed to enable secure communication between independent blockchains, allowing the transfer of data or value without a. Polkadot's native DOT token has three main functions: staking for operations and security, facilitating network governance, and bonding tokens to connect. DOT has a current supply of approximately 1 billion tokens following the community governance vote in to redenominate at a ratio from the 10 million. The price of Polkadot in the ICO was $ and the token sale ended on Jul 27, Since then, DOT price increased x against US Dollar. By , the situation had changed: As of August 27, , one DOT token was worth U.S. dollars. Read more. Polkadot (DOT) price per day from December 2. the quantity of DOT tokens you want to purchase AND; the price (per token) you are willing to pay. The closer your price is to the lowest asking price, the. Polkadot is a blockchain network of networks designed to challenge our assumptions, directed and governed by those who hold the DOT token. By holding DOT, you. Discover fundraising information: ICO Funding Rounds, return on investment (ROI), prices of investors, and funds raised by Polkadot (DOT). The sale raised US$ million through a public sale of half the total 10 million supply of its token DOT. As the native coin of its namesake blockchain. Polkadot is a decentralized protocol designed to enable secure communication between independent blockchains, allowing the transfer of data or value without a. Polkadot's native DOT token has three main functions: staking for operations and security, facilitating network governance, and bonding tokens to connect. DOT has a current supply of approximately 1 billion tokens following the community governance vote in to redenominate at a ratio from the 10 million. The price of Polkadot in the ICO was $ and the token sale ended on Jul 27, Since then, DOT price increased x against US Dollar.

The native token, DOT, is used in staking, governance, and bonding tokens to connect parachains to the Polkadot network. DOT coins were redominated on. Polkadot crypto is a decentralized currency that enables the seamless transfer of different data types, assets, and tokens across various blockchain networks. Where can you buy Binance-Peg Polkadot? DOT tokens can be traded on decentralized exchanges. The most popular exchange to buy and trade. NPoS evenly distributes stake across all DOT holders, enabling all token holders to help secure the network and earn staking rewards. Native nomination pools. DOT is the native token of the Polkadot network, serving three key functions: governance, staking, and bonding. tokens. Space for Parachains is limited and regularly auctioned off for DOT, Polkadot's native cryptocurrency token. DOT price is updated live on Binance. dobrozorova.ru: Cryptochips | Polkadot (DOT) Physical Crypto Coin | Commemorative Cryptocurrency You Can HODL: Office Products. The DOT token is the native cryptocurrency of the Polkadot network and serves several functions on the platform. It is used for governance, staking, transaction. Vesting schedule starting on (May, ) - Find the Tokenomics data, Token Allocation, Emission, & Unlocks calendar. Dot (DOT). Planck, Million (MDOT). Development. Original The DOT is its native token, and DOTs were released with the launch of the genesis block. The price of Polkadot (DOT) is $ today, as of Aug 27 a.m., with a hour trading volume of $M. Over the last 24 hours, the price has. Measure and evaluate Blockchains and Dapps through traditional financial metrics. Token Terminal is a Crypto Analytics Platform with Advanced Metrics. The DOT token is what powers the network, being Polkadot's native coin. It is used for paying network fees, connecting parachains to the network, governance. The current real time Polkadot price is $, and its trading volume is $,, in the last 24 hours. DOT price has plummeted by % in the last day. Polkadot uses DOT tokens for operating on its network. DOT serves multiple Token Allocation. Token Sales. Private Sale Token Sale The platform's native cryptocurrency, the DOT token, plays a central role in its ecosystem, facilitating transactions, governance, and incentivization. As. Polkadot, with its native DOT coin, is a blockchain ecosystem focused on interoperability and scalability. Polkadot has a main blockchain called the Relay. Polkadot's native token, DOT, is used for staking, governance, and transaction fees within the network. New on Coinmetro. Propy. PRO. Aptos. APT. Propbase. BscScan allows you to explore and search the Binance blockchain for transactions, addresses, tokens, prices and other activities taking place on BNB Smart. Firstly, DOT tokens are instrumental in network security through a staking mechanism. By staking their DOT, holders can actively participate as validators.

How Often Can A Person Declare Bankruptcy

There are no clear restrictions about the number of bankruptcy cases that you are eligible to file unless a bankruptcy court issues orders stating otherwise. The rules for discharging taxes are complicated; if you have tax liabilities you should consult with an attorney prior to filing bankruptcy. You may receive a. You can receive a Chapter 7 bankruptcy discharge every eight years. But you won't need to wait that long if you filed a different chapter before, such as. Dismissal: IRS may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. Discharge: Will eliminate (discharge) tax debts paid. 2 years from when your bankruptcy ends, whichever is later. For more information see: Who will know I'm bankrupt? Your trustee may sell your assets. You are. Chapter 7 bankruptcies stay on consumers' credit reports for 10 years from their filing date. Chapter 13 bankruptcy: Harrison refers to Chapter 13 as the “wage. The law allows you to file Chapter 7 bankruptcy once every eight years, up to a total of three times in your life. Previously Filed Chapter 13 and Filing. Key Takeaways · It may be time to file for bankruptcy when your bills have become unmanageable and you have no other options to pay your debt. · Filing for. Can you file more than once? The short answer is yes. These are referred to as an area as "repeat filings" or "multiple discharges." There are only a few rules. There are no clear restrictions about the number of bankruptcy cases that you are eligible to file unless a bankruptcy court issues orders stating otherwise. The rules for discharging taxes are complicated; if you have tax liabilities you should consult with an attorney prior to filing bankruptcy. You may receive a. You can receive a Chapter 7 bankruptcy discharge every eight years. But you won't need to wait that long if you filed a different chapter before, such as. Dismissal: IRS may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. Discharge: Will eliminate (discharge) tax debts paid. 2 years from when your bankruptcy ends, whichever is later. For more information see: Who will know I'm bankrupt? Your trustee may sell your assets. You are. Chapter 7 bankruptcies stay on consumers' credit reports for 10 years from their filing date. Chapter 13 bankruptcy: Harrison refers to Chapter 13 as the “wage. The law allows you to file Chapter 7 bankruptcy once every eight years, up to a total of three times in your life. Previously Filed Chapter 13 and Filing. Key Takeaways · It may be time to file for bankruptcy when your bills have become unmanageable and you have no other options to pay your debt. · Filing for. Can you file more than once? The short answer is yes. These are referred to as an area as "repeat filings" or "multiple discharges." There are only a few rules.

Bankruptcy is a legal process, so it begins when the debtor files a petition with the relevant bankruptcy court. This is often achieved through the help of a. To decide if you should file for bankruptcy, you need to know: What Damages for personal injury you caused when driving while intoxicated; Debts to. Although you may not have expected to be here again, if you find yourself unable to continue paying your debts it is possible to file bankruptcy more than once. 5. How often can I file bankruptcy? You can file for Chapter 7 bankruptcy again after six years has passed from the date of your last filing. A. There are time limits between filings, but there is no limit on the number of times you can file. Theoretically, someone with faulty debt-management skills. If you file for Chapter 7, these debts will remain when your case is over. In Chapter 13, you'll pay these debts in full through your repayment plan. Debt. In Chapter 13 bankruptcy you must have a reliable source of income that you can use to repay some portion of your debt in order to file for Chapter When you. About Bankruptcy Filing bankruptcy can help a person by discarding debt or making a plan to repay debts. A bankruptcy case normally begins when the debtor. You cannot file for Chapter 7 bankruptcy more often than every eight years. You have a co-signer on a loan, and you do not want to stick the co-signer with your. An individual can file for Chapter 7 bankruptcy only once in an eight-year period. Some filers file Chapter 13 petitions soon after Chapter 7, but four. How Often Can You Declare Bankruptcy? You can file bankruptcy as many times as you want. You can get discharged from your debt often, too. While there are no. A person is fully entitled and permitted to file bankruptcy twice. The only rules on filing twice involve the time between filings, and that depends on. How Many Times Are You Allowed To File for Bankruptcy? Bankruptcy cases can be filed by debtors as they like. Bankruptcy laws do not limit people to a certain. The Bankruptcy Code allows spouses to file jointly for bankruptcy. The question of whether you and your spouse should file a bankruptcy together depends on. Yes, you may file for bankruptcy twice, however, it is important to understand that bankruptcy and debt discharge are not the same. You can file for bankruptcy. Legally speaking, a person can file for bankruptcies as many times as they want. However, the process becomes more restrictive. With a second bankruptcy, you. Can only be filed once every eight years. · Can be filed anytime after the completion of a Chapter 13 case, unless the unsecured creditors in the Chapter 13 case. You cannot have more than $, of unsecured debt and $1,, of secured debt (for ) if you want to file for this type of bankruptcy. Will Filing for. How Long do I Have to Wait Between Bankruptcy Filings? · You can file for Chapter 7 bankruptcy between six and eight years after your previous filing · You can. Federal law does not necessarily place restrictions on the time frame for filing for bankruptcy more than once, but it does limit how often an individual can.