dobrozorova.ru Tools

Tools

How To Start Building An Investment Portfolio

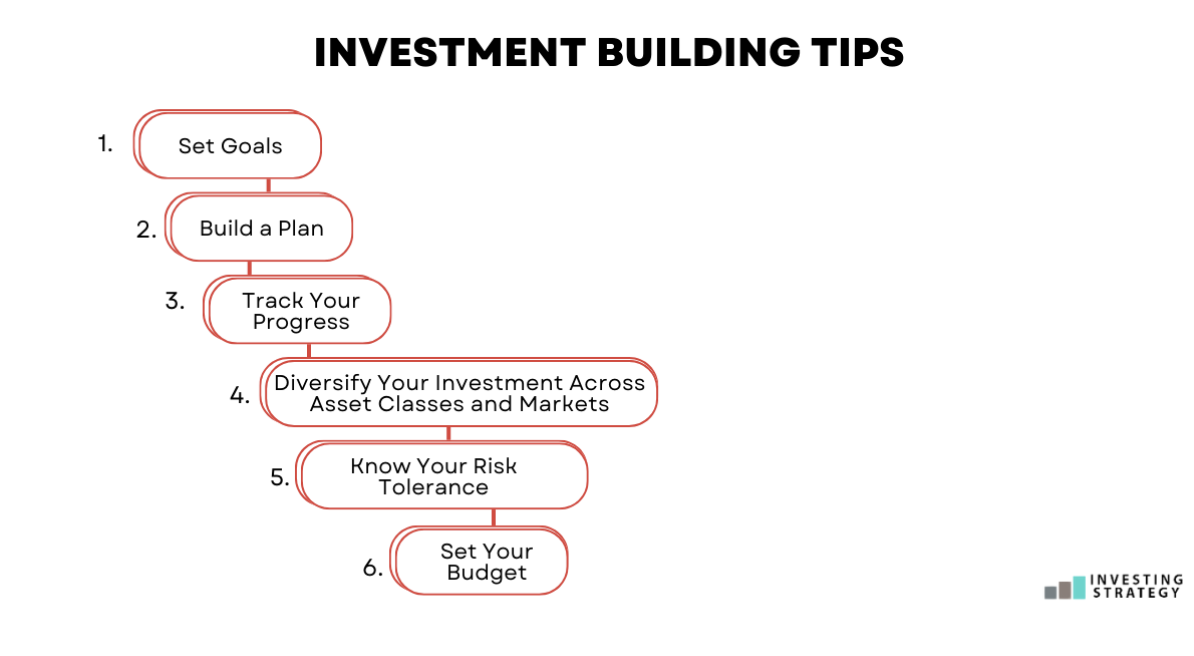

1. Develop investment goals · 2. Determine your appetite for risk · 3. Work out the right investment for your risk appetite · 4. Build and monitor your investment. Growth portfolios are designed to build up an increase in returns over time, through individual stocks growing in value and through the reinvestment of. The first step is to decide the level of risk you're comfortable with. Higher-risk investments can generate high rewards, but they also can result in large. Creating an investment portfolio from scratch is easy if you follow a step-by-step process. And that's exactly what I'm going to show you. Tools to get started setting up your portfolio · Correlation is king. · There are lots of different ways to split your investments – some conservative, some more. Tips for building a real estate portfolio include exploring diverse investment options, setting clear financial goals, researching local markets, and. We'll take you through some key basics to plan and build your portfolio based on your risk appetite and financial goals. What is rebalancing? · Figure out how often you want to invest: weekly, monthly or every paycheque. · When picking a dollar amount to invest, try to find a. We take a closer look at asset allocation and set out the four steps to build your own personalised portfolio from scratch. 1. Develop investment goals · 2. Determine your appetite for risk · 3. Work out the right investment for your risk appetite · 4. Build and monitor your investment. Growth portfolios are designed to build up an increase in returns over time, through individual stocks growing in value and through the reinvestment of. The first step is to decide the level of risk you're comfortable with. Higher-risk investments can generate high rewards, but they also can result in large. Creating an investment portfolio from scratch is easy if you follow a step-by-step process. And that's exactly what I'm going to show you. Tools to get started setting up your portfolio · Correlation is king. · There are lots of different ways to split your investments – some conservative, some more. Tips for building a real estate portfolio include exploring diverse investment options, setting clear financial goals, researching local markets, and. We'll take you through some key basics to plan and build your portfolio based on your risk appetite and financial goals. What is rebalancing? · Figure out how often you want to invest: weekly, monthly or every paycheque. · When picking a dollar amount to invest, try to find a. We take a closer look at asset allocation and set out the four steps to build your own personalised portfolio from scratch.

Develop a Plan · Determine Your Initial Investment · Find Budget-Friendly Investment Products · Protect Your Money · The Bottom Line. The first step is to decide on an asset allocation. All it means is how you spread your money across different investments. Generally, when you decide it's time to start investing and you want to build a portfolio, you'll work with an advisor who understands your financial goals and. Finally! Provided you understand your own risk tolerance and investment timeline; it's now time to start building your investment portfolio. This is simply just. An investment portfolio is a collection of assets, often with varying characteristics, that can help deliver on your financial objectives over the longer term. An investment portfolio is a set of financial assets owned by an investor that may include bonds, stocks, currencies, cash and cash equivalents. A portfolio can help you diversify your assets and spread your risk across stocks, bonds, and other types of investments. The first step to creating a successful investment portfolio is to understand your time horizon. By calculating this, we will be able to construct a foundation. No matter what your investment style – aggressive, conservative or somewhere in between –here are some guidelines for building a stock portfolio that pays off. Start with your needs and goals. The first step in investing is to understand your unique goals, timeframe, and capital requirements. · Assess your risk. You can start building the portfolio from tomorrow. · The best way is to do via monthly SIP in Nifty 50 Index MF for beginners. · Later, you can. Understanding Investment Portfolios To build a successful investment portfolio, you need to start by defining your investment goals and. Diversify Your Investment Portfolio. Think about spreading your investments across different types of assets. Markets are unpredictable. The purpose of. An investment portfolio is a collection of assets holding investments like stocks, bonds, mutual funds, exchange traded funds, cash, and cash equivalents. First, take a look at your financial situation and gauge your own investment knowledge and experience. Do you understand your financial situation? Can you. We'll walk you through the process of starting your investment journey, from defining your financial goals and assessing your risk tolerance to choosing a. Constructing an investment portfolio is about choosing a range of investments that are targeted at achieving your goals & objectives. How you divide your total portfolio into stocks, bonds and cash investments will influence your total returns greatly. Over the long-term, stocks have provided. What could I invest in? · Decide on your goals, time horizon and liquidity needs · Determine your risk tolerance · Build a portfolio · Review your investments. In building your portfolio, you need to consider your investment objectives and goals, investment horizon and available funds.

Volkswagen Manufacturer Warranty

The program is endorsed by Volkswagen and offers extended warranties for both new and used Volkswagen vehicles that can cover you up to ,00 miles, depending. In fact, the Volkswagen Factory Warranty coverage will transfer to any owner who purchases the vehicle within that initial 6-year/72,mile coverage period. Learn about the official Volkswagen Warranty and what is covered. Help make sure your VW vehicle is covered and protected for the long term. Volkswagen Parts Warranty. Parts come with a 2-year or unlimited-kilometre limited warranty from the purchase date, with some parts having longer warranties. You can also enjoy several other benefits thanks to this Volkswagen extended warranty, such as the 6 years or the 72, miles, whichever occurs first. This is. For the extended warranty, there are 4 package levels: Powertrain, Silver, Gold, and Platinum. As you upgrade to a higher level, you will get more benefits and. New Volkswagen vehicles come with a 6-year/72,mile New Vehicle Limited Warranty* and a 7-year/,mile Limited Warranty Against Corrosion Perforation. All Volkswagen approved used cars are provided with a 1-Year warranty cover − one of the most comprehensive warranties available. So you're safe in the. Each program has a year/,mile warranty coverage. While we don't have pricing details, below is a look at what's covered. The program is endorsed by Volkswagen and offers extended warranties for both new and used Volkswagen vehicles that can cover you up to ,00 miles, depending. In fact, the Volkswagen Factory Warranty coverage will transfer to any owner who purchases the vehicle within that initial 6-year/72,mile coverage period. Learn about the official Volkswagen Warranty and what is covered. Help make sure your VW vehicle is covered and protected for the long term. Volkswagen Parts Warranty. Parts come with a 2-year or unlimited-kilometre limited warranty from the purchase date, with some parts having longer warranties. You can also enjoy several other benefits thanks to this Volkswagen extended warranty, such as the 6 years or the 72, miles, whichever occurs first. This is. For the extended warranty, there are 4 package levels: Powertrain, Silver, Gold, and Platinum. As you upgrade to a higher level, you will get more benefits and. New Volkswagen vehicles come with a 6-year/72,mile New Vehicle Limited Warranty* and a 7-year/,mile Limited Warranty Against Corrosion Perforation. All Volkswagen approved used cars are provided with a 1-Year warranty cover − one of the most comprehensive warranties available. So you're safe in the. Each program has a year/,mile warranty coverage. While we don't have pricing details, below is a look at what's covered.

In fact, the Volkswagen Factory Warranty coverage will transfer to any owner who purchases the vehicle within that initial 6-year/72,mile coverage period. No. Extended warranty in general is not a good use of your money. 98% of people never use it at all. Sure, it may give you a piece of mind but you likely won't. Can warranty cover be extended? Our Extended Warranty is a month insurance policy and we'll send you an email close to your renewal date to see if you want. Your VW CPO warranty begins after the expiration of the new car warranty and lasts for an additional months or 24K miles. 3 years/ 36, miles. This warranty covers any repair to correct a defect in the manufacturer's material or workmanship (i.e. mechanical defects), except wheel. How Does the Volkswagen Factory Warranty Affect My CPO Coverage? · 4 years or 50, miles of warranty coverage, whichever comes first · 2 years or 20, miles. What is the Volkswagen Extended Warranty? · 10 Years / , Miles · Everything in Powertrain · Climate Control · Shocks · Front & Rear Suspension · Fuel System. Volkswagen Extended Warranty Coverage options last up to months or , miles, and you'll get a whole lot covered by the Volkswagen Drive Easy Program. The Volkswagen warranty lasts for 4 years/ miles (whichever comes first) and covers almost any component except for a list of exclusions. All of our model year to vehicles come with scheduled 2 years of maintenance service 6, 3 years of roadside assistance 7, 4 years or 50K miles . With the purchase of a new Volkswagen vehicle, there is the benefit of a 6-year/72,mile New Vehicle Limited Warranty*. When you purchase a new Volkswagenmodel, it comes standard with a 4-year/50,mile Limited Warranty. You also get a 7-year/,mile Limited Warranty. When you bring home a new VW on Dumas and Pampa roads, you'll most likely first be offered the Volkswagen Factory Warranty which is also referred to as the. Every Volkswagen is designed with quality in mind. So our 6 years/72, miles (whichever occurs first) New Vehicle Limited Warranty isn't just extensive, it's. When you buy a new Volkswagen vehicle, it comes with an impressive 4-year/50,mile New Vehicle Limited Warranty, in addition to the 7-year/,mile. All of our model year to vehicles come with scheduled 2 years of maintenance service 6, 3 years of roadside assistance 7, 4 years or 50K miles . Volkswagen Factory Warranty Coverage · Battery (3 years or 36, miles) · Brake Pads/Shoes (1 year or 12, miles) · Halogen/Xenon Bulbs (3 years or 36, miles). Limited Warranty for new and factory-remanufactured replacement Parts and Accessories: · Free repair or replacement of defective Parts and Accessories for 1 year. The Volkswagen warranty lasts for 4 years/ miles (whichever comes first) and covers almost any component except for a list of exclusions. Volkswagen Extended Warranty Coverage options last up to months or , miles, and you'll get a whole lot covered by the Volkswagen Drive Easy Program.

Navy Federal Referral Bonus 2021

However, the Small Business Administration closed the program on May 31, Does Navy Federal offer private or federal student loans? Navy Federal. Most credit card companies charge late payment fees upward of $ No Foreign Transaction Fee. Navy Federal Credit Union does not charge a fee for foreign. You will be considered an active Member in Navy Federal as long as you have a Membership Savings. Account balance of $50 or more; have a Membership Savings. The official term for withholding money from a payment is "offset" or "administrative offset." The program that offsets federal payments for overdue debts is. This bonus offer for new business checking account customers expires on September 9, Can you avoid the monthly service fee? Yes. The BMO Simple Business. Earn $ bonus cash back when you spend $3, within 90 days of account opening. Get a one-time $98 statement credit when you pay $49 or more for an annual. The Senior Enlisted Reward Program lets you earn $ for each family member or friend you refer to the credit union. Navy Federal coupon codes are not required. Alston v. Navy Federal Credit Union et al, No. cv - Document 43 (D. Md. ) case opinion from the District of Maryland US Federal District. I received a CLI from $1, to on my cash rewards card about 2 months ago and then a couple weeks ago I applied for and was approved for a flagship with. However, the Small Business Administration closed the program on May 31, Does Navy Federal offer private or federal student loans? Navy Federal. Most credit card companies charge late payment fees upward of $ No Foreign Transaction Fee. Navy Federal Credit Union does not charge a fee for foreign. You will be considered an active Member in Navy Federal as long as you have a Membership Savings. Account balance of $50 or more; have a Membership Savings. The official term for withholding money from a payment is "offset" or "administrative offset." The program that offsets federal payments for overdue debts is. This bonus offer for new business checking account customers expires on September 9, Can you avoid the monthly service fee? Yes. The BMO Simple Business. Earn $ bonus cash back when you spend $3, within 90 days of account opening. Get a one-time $98 statement credit when you pay $49 or more for an annual. The Senior Enlisted Reward Program lets you earn $ for each family member or friend you refer to the credit union. Navy Federal coupon codes are not required. Alston v. Navy Federal Credit Union et al, No. cv - Document 43 (D. Md. ) case opinion from the District of Maryland US Federal District. I received a CLI from $1, to on my cash rewards card about 2 months ago and then a couple weeks ago I applied for and was approved for a flagship with.

* Navy Federal Visa Signature Flagship Rewards Cardholders are responsible ADD (10/07). Page 9. © Navy Federal. NFCU CC (). FL The student checking differs from the basic checking account only by offering ATM fee refunds. Overdraft protection options are available on all of Navy's. Cardholders can use the Navy Federal Credit Card to build/repair their credit. The annual fee for this secured card is $0 and there's a $ minimum. CNIC M CH-1 1 Aug Navy Housing Referral Services · CNIC M CNIC INST Navy Housing Inventory and Utilization Management. To be eligible for the $ bonus offer (the “Bonus Offer”), Navy Federal Members must use the Navy Federal Car Buying Service powered by TrueCar to receive an. February 08, Navy Federal Routing Number. Find your routing number and everything else you The first four digits of your routing number refer to. (1) Refer to Note 2 for additional details. The accompanying notes are an integral part of these consolidated financial statements. Page Sign up bonus: No card provides a sign-up incentive. Benefits: No foreign transfer fee or balance transfer is required for the Navy Federal rewards Secured. The Workforce Recruitment Program (WRP) is a recruitment and referral program that connects federal from a U.S. accredited college or university. Navy Federal Credit Union. Feb - Present 2 years 8 months. Aston Carter Graphic. LOA Contractor. Aston Carter. Jul - Mar 9 months. This program is offered, in part, by Anywhere Leads Inc., which may receive a co-operative brokerage fee as a result of a referral to any affiliated real. through Navy Federal Credit Union in order to receive the benefits of this program. brokerage fee as a result of a referral to any affiliated real. Refer a friend and we'll give you both $30! Just visit dobrozorova.ru to receive a shareable referral link. Send your link to all of your friends. The average Msr base salary at Navy Federal Credit Union is $44K per year. The average additional pay is $3K per year, which could include cash bonus, stock. There is a Navy Federal co-branded American Express Card called the More Rewards American Express, and there is a complete review of the card on dobrozorova.ru employees and get real answers from people on the inside. Ask a question. Join the Navy Federal Credit Union team. See Our Latest Jobs. Jul 26, , I filled out the Navy Federal form regarding Required Mandatory bonus, there's a TJ Maxx/HomeGoods store nearby. Living Spaces too. Overall. , ECF No. 1, and additionally filed the pending Motion for Leave to fee.” Kennedy v. Wilkinson, No. cvCCB, WL , at *1 (D. You will receive your new account bonus within 10 business days of completing your final qualifying direct deposit. Is there a time limit on the offer? To. Do you agree with Navy Federal Credit Union's 4-star rating? Check out what people have written so far, and share your own experience.

Top Paper Trading Apps

There are several great apps for paper trading, but one of the most popular choices is Thinkorswim by TD Ameritrade. It offers a comprehensive. A new generation, world-renowned social trading app, eToro is a one-stop destination for those who'd like to learn more about trading. eToro enriched its modern. MarketWatch; Investopedia; Finviz; Thinkorswim; eToro. MarketWatch. Dubbed the "virtual stock exchange," this. In this blog post, we'll delve into some of the best paper trading apps in India, highlighting their features and benefits for aspiring investors. By engaging in paper trading, individuals can gain valuable experience without the fear of losing their hard-earned capital. The E*TRADE app provides a seamless. Tinker is one of the best option for freshers who entered in Stock Market and Safe Investment. Great learning experience. Amazing UI. No ads in the app which is. We'll be taking you through six vetted, tried-and-tested brokerages—with a primary focus being on their paper trading mobile apps. Webull is a brokerage that caters to the smartphone generation of new investors. Their paper trading app is much more pared down than the more robust offerings. eToro - Best overall · TradeStation - Best for experienced brokers · WeBull - Best desktop app · Interactive Brokers - Best for paper options trading · AvaTrade -. There are several great apps for paper trading, but one of the most popular choices is Thinkorswim by TD Ameritrade. It offers a comprehensive. A new generation, world-renowned social trading app, eToro is a one-stop destination for those who'd like to learn more about trading. eToro enriched its modern. MarketWatch; Investopedia; Finviz; Thinkorswim; eToro. MarketWatch. Dubbed the "virtual stock exchange," this. In this blog post, we'll delve into some of the best paper trading apps in India, highlighting their features and benefits for aspiring investors. By engaging in paper trading, individuals can gain valuable experience without the fear of losing their hard-earned capital. The E*TRADE app provides a seamless. Tinker is one of the best option for freshers who entered in Stock Market and Safe Investment. Great learning experience. Amazing UI. No ads in the app which is. We'll be taking you through six vetted, tried-and-tested brokerages—with a primary focus being on their paper trading mobile apps. Webull is a brokerage that caters to the smartphone generation of new investors. Their paper trading app is much more pared down than the more robust offerings. eToro - Best overall · TradeStation - Best for experienced brokers · WeBull - Best desktop app · Interactive Brokers - Best for paper options trading · AvaTrade -.

Experience live stock trading on India's first % real-time platform using virtual money. Test strategies, trade equities, options, and futures. paperMoney is the virtual trading experience that lets you practice trading on thinkorswim using real-time market data—all without risking a dime. paperMoney is the virtual trading experience that lets you practice trading on thinkorswim using real-time market data—all without risking a dime. Webull Mobile App Stay on top of the markets and your accounts wherever you go. Webull Mobile App. Webull Desktop App. Experience the power of. Webull. Webull's paper trading platform caters to both beginners and experts. With a user-friendly app and a wealth of information, it provides a learning. Moneypot is a cloud-based stock market simulation for colleges, universities, corporations and investors. It helps to learn the stock trading strategies on. Paper trading, also known as simulated trading, lets you trade with fake money and practice buying and selling securities. These apps allow you to simulate trading in a real market environment without putting any actual funds at risk. Paper trading is a way of practicing trading without using real money. It allows you to test your strategies and skills in a simulated environment. What Is The Best Paper Trading App ; K · claytrader ; · simple_investing_basics. ; 92K · thealmightyjt. ; K · conquest_trader. ; K. Top Paper Trading Apps · 1. eToro: Best Overall · 2. Interactive Brokers: Best Investment Offerings · 3. TD Ameritrade: Best for U.S. Traders · 4. IG: Best. This blog will dive into the top 10 paper trading apps, each offering unique features to cater to various trading needs. Master your investing skills on virtual trading apps without putting your real money at risk. Try and test different trading strategies on the real-time market. There are several great apps for paper trading, but one of the most popular choices is Thinkorswim by TD Ameritrade. It offers a comprehensive. Paper Trading Platform is a virtual trading software that offers life like execution for ETF, equities and options without any risk. Ans: Among the best paper trading apps in India embody Zerodha, Upstox, ICICI Direct, and Moneybhai by Moneycontrol. These platforms provide. For the best user experience, please use an updated browser. Power E paper trading on Power E*TRADE and Power E*TRADE app. Paper trading. Trade. thinkorswim: Trade. Invest. 4+ · TD Ameritrade Mobile, LLC · iPhone Screenshots · Additional Screenshots · Description · What's New · Ratings and Reviews · App Privacy. Some brokerages with virtual accounts include Thinkorswim by TD Ameritrade, Webull and TradeStation. MarketWatch and Wealthbase offer free stock market. Webull Mobile App Stay on top of the markets and your accounts wherever you go. Webull Mobile App. Webull Desktop App. Experience the power of.

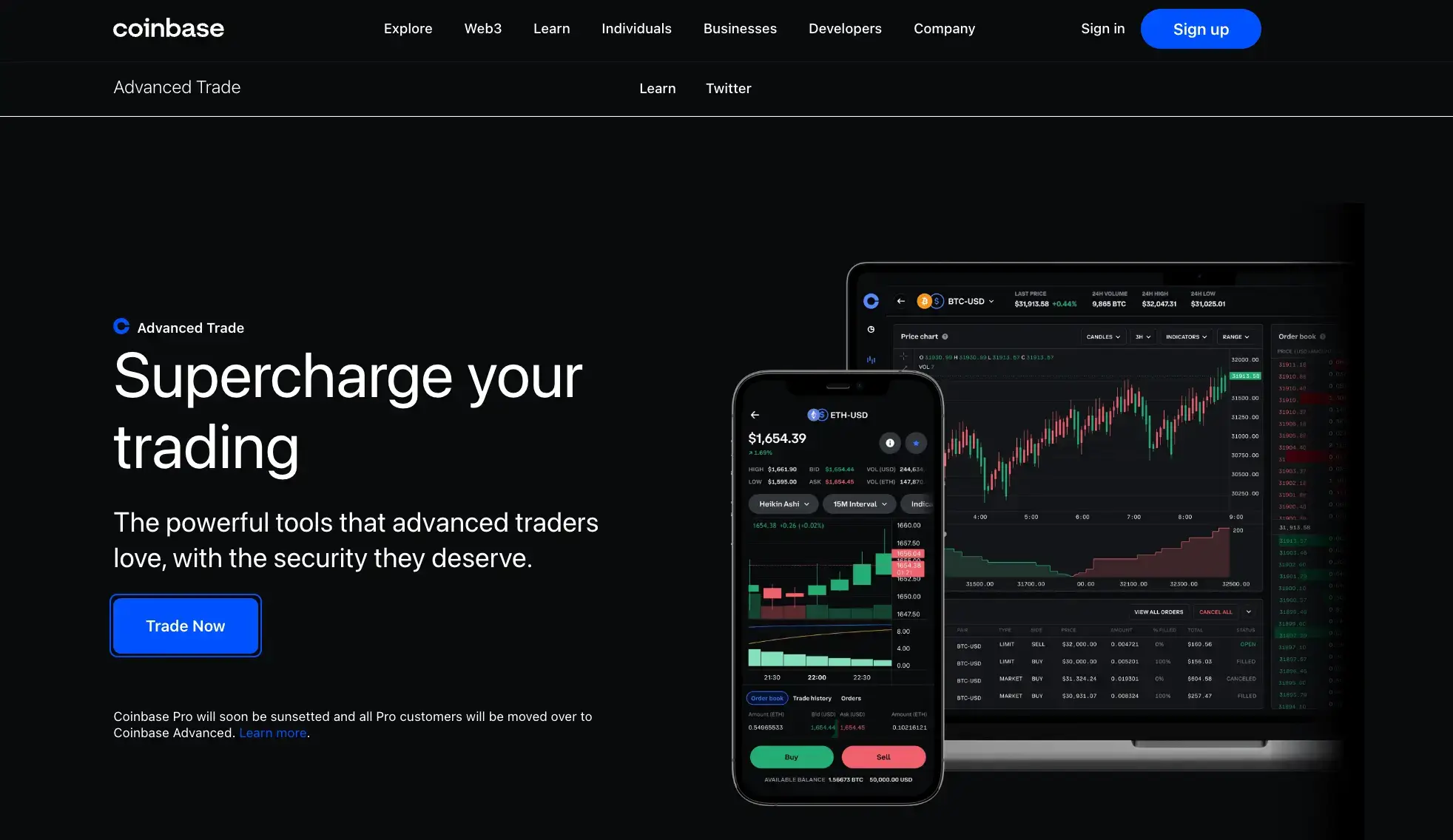

Why Cant I Buy On Coinbase

A subset of those assets can be traded on Coinbase. Information for cryptocurrencies not available for trade on Coinbase is provided for educational purposes. Bank Compatibility: Confirm that your bank is compatible with Coinbase. Some banks have restrictions or specific procedures for linking accounts to. 1. Insufficient funds: If there are not enough funds available on your credit card to cover the transaction, Coinbase may reject it. · 2. Credit. Coinbase wallet. But when you try to with draw them They can not be withdrawn. And support on the app doesn't help you get your funds either. It is a scam. Alternative crypto exchange and trading platforms include Gemini, Uphold, Binance and Kraken. How do you use Coinbase? To use Coinbase to buy, sell and transfer. dobrozorova.ru and Coinbase are crypto exchange platforms that let investors buy How Do dobrozorova.ru and Coinbase Work? dobrozorova.ru and Coinbase use similar. Note: Coinbase no longer supports linking new credit cards and some card issuers are blocking digital currency purchases with existing credit cards. If you. Buy on dobrozorova.ru · Sign in to Coinbase. · Select Buy / Sell · From the Buy tab, select the asset you'd like to purchase. · Enter the amount you'd like to buy. 1. Create a Coinbase account ; 2. Add a payment method ; 3. Start a trade ; 4. Select the crypto you're looking to buy from the list of assets ; 5. Enter the amount. A subset of those assets can be traded on Coinbase. Information for cryptocurrencies not available for trade on Coinbase is provided for educational purposes. Bank Compatibility: Confirm that your bank is compatible with Coinbase. Some banks have restrictions or specific procedures for linking accounts to. 1. Insufficient funds: If there are not enough funds available on your credit card to cover the transaction, Coinbase may reject it. · 2. Credit. Coinbase wallet. But when you try to with draw them They can not be withdrawn. And support on the app doesn't help you get your funds either. It is a scam. Alternative crypto exchange and trading platforms include Gemini, Uphold, Binance and Kraken. How do you use Coinbase? To use Coinbase to buy, sell and transfer. dobrozorova.ru and Coinbase are crypto exchange platforms that let investors buy How Do dobrozorova.ru and Coinbase Work? dobrozorova.ru and Coinbase use similar. Note: Coinbase no longer supports linking new credit cards and some card issuers are blocking digital currency purchases with existing credit cards. If you. Buy on dobrozorova.ru · Sign in to Coinbase. · Select Buy / Sell · From the Buy tab, select the asset you'd like to purchase. · Enter the amount you'd like to buy. 1. Create a Coinbase account ; 2. Add a payment method ; 3. Start a trade ; 4. Select the crypto you're looking to buy from the list of assets ; 5. Enter the amount.

User reports indicate no current problems at Coinbase. Coinbase is a digital asset exchange that facilitates trading of digital currencies including Bitcoin. ACH bank transfer. Wire transfer ; You must have a bank account in your legal name and it must match the name on your Coinbase account. You cannot transfer funds. Buy on dobrozorova.ru · Sign in to Coinbase. · Select Buy / Sell · From the Buy tab, select the asset you'd like to purchase. · Enter the amount you'd like to buy. How to buy Coinbase stock · 1. Open a brokerage account · 2. Figure out your budget · 3. Do your research · 4. Place an order. You can make a purchase with a credit or debit card if your card supports "3D Secure" (3DS). With this payment method, you will not have to pre-fund your. Coinbase (no longer allows users to add new credit cards to their There's a reason some creditors won't let you buy cryptocurrency with their cards. When you use a linked bank account (ACH) to buy crypto or add cash to your account balance, the funds are placed on hold and won't be immediately available to. Whereas for Coinbase exchange, if you forget your password, there's plenty of support to help you get back into your account, and because you don't manage your. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs. You will need a valid ID and may be asked for proof of address in order to transact, so be sure to have those ready. Verifying your ID may take longer than a. Your account purchase or deposit limits are determined by many factors, including verification completed on your account, your purchase history, your payment. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. We're the only publicly traded crypto. User reports indicate no current problems at Coinbase. Coinbase is a digital asset exchange that facilitates trading of digital currencies including Bitcoin. Coinbase: Buy Bitcoin & Ether 4+. Most trusted crypto exchange. Coinbase The only thing is you cant buy via credit card on this App. Very frustrating. can't be changed. (1/2) ^IU. 7. 5 Coinbase - Buy and Sell Bitcoin, Ethereum, and more with trust. Coinbase is a. Buying Coinbase shares · Create an account or log in and go to our trading platform · Search for 'Coinbase' · Select 'buy' in the deal ticket · Choose your position. Coinbase, the largest US-based crypto trading platform, is facing obstacles in the form of hostile regulators (including the SEC, which sued the company), data. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto.

Open University Physics

All modules in Physics. Choose a focused physics module or study physics as part of a multidisciplinary science module. Laser reflecting on an optic table. Study online through Open Universities Australia. Explore all degrees, subjects and short courses now. Our IOP-accredited physics degree takes you from a broad appreciation of science to the cutting edge of contemporary physics, using a combination of modern. Study online through Open Universities Australia. Explore all degrees, subjects and short courses now. A-Level Physics course online completed from home at your own pace from anywhere in the world. Students can enrol anytime of the year. Enrol in a physics course though Open Universities Australia and explore the "how" and "why" of the universe. Honestly, most upper year Physics courses at a brick uni don't even have labs/experiments. It's mostly theory, mathematics and a lot of coding. Physics is one of the six (06) Departments in the Faculty of Natural Sciences at the Open University of Sri Lanka. Academic staff is housed at the second. This free course, Particle physics, will give you an overview of current concepts and theories in the field. You will learn about the fundamental components. All modules in Physics. Choose a focused physics module or study physics as part of a multidisciplinary science module. Laser reflecting on an optic table. Study online through Open Universities Australia. Explore all degrees, subjects and short courses now. Our IOP-accredited physics degree takes you from a broad appreciation of science to the cutting edge of contemporary physics, using a combination of modern. Study online through Open Universities Australia. Explore all degrees, subjects and short courses now. A-Level Physics course online completed from home at your own pace from anywhere in the world. Students can enrol anytime of the year. Enrol in a physics course though Open Universities Australia and explore the "how" and "why" of the universe. Honestly, most upper year Physics courses at a brick uni don't even have labs/experiments. It's mostly theory, mathematics and a lot of coding. Physics is one of the six (06) Departments in the Faculty of Natural Sciences at the Open University of Sri Lanka. Academic staff is housed at the second. This free course, Particle physics, will give you an overview of current concepts and theories in the field. You will learn about the fundamental components.

You get proper teaching, feedback and assessment by proper academics in an institution which is fully recognised as a university, and has been. Browse physics postgraduate courses at Open University on dobrozorova.ru Find your ideal course and apply now. Interlocking OU, Dodge Family College of Arts and Sciences, Homer L. Dodge OU. Homer L. Dodge Department of Physics and Astronomy W. Brooks St. dobrozorova.ru (Hons.) in Physics. at. Netaji Subhas Open University. Entry Requirements · N/A · Mandatory Subjects: Physics · Candidate must have secure 40% marks in. Physics Degrees from The Open University. Explore the largest and smallest scales of the Universe. Part or Full time Study to suit you. PHYSICS PROGRAMME: In order to make the vision and mission of the National Open University of Nigeria (NOUN) a reality in an Open and Distance Learning (ODL). Degree of IGNOU or any recognized Open University with a minimum of 32 Credits of Physics, and Mathematics as one of the subjects. Fee Structure. Rs Explore our Physics Research Degrees. Physics Research Degrees from The Open University. Research includes Cold Atoms, Education and More. The Open University of Sri Lanka. Address: Dr (Mrs) K.N.D. Bandara, Head/ Department of Physics, Faculty of Natural Sciences. Queen Mary University of London in partnership with the Open University, offers a flexible route to a degree in Physics for students without standard entry. A degree from any OU is comparable to a Physics degree from a comparably ranked uni. It's not equivalent to one from Cambridge or MIT unless the. In this free course, Particle physics, you will be introduced to the realm of particle physics that lies at the heart of a scientific understanding of the. The Open University's School of Physical Sciences is a lively and innovative community with interests in physics, astronomy, and planetary and space science. MIT OpenCourseWare is a web based publication of virtually all MIT course content. OCW is open and available to the world and is a permanent MIT activity. physics and applied physics. Learn more at dobrozorova.ru Copyright © Yale University · All rights reserved. Most of the lectures. Prerequisites for this course are: Infinitesimal Calculus I (), Infinitesimal Calculus II () and Linear Algebra I (). Physics 58 credits1. Physics Certificates from The Open University. Choose to study Part or Full time to suit you. You could finish in as little as One Year. PHYSICS PROGRAMME: In order to make the vision and mission of the National Open University of Nigeria (NOUN) a reality in an Open and Distance Learning (ODL). Further your understanding of physics through a mixture of compulsory and optional study modules that range from classical to quantum physics. FUSION is the Open University Physics & Astronomy society. We were formed in by students who recognised the need to create a society for OU students and.

Average Balance Transfer Amount

The average credit card balance transfer fee is % of the amount you transfer, and you need to take this cost into account when deciding whether a. With an APR as low as % and no annual or balance transfer fees, our low rate credit card is great for large purchases you want to pay off over time. Enjoy rates as low as % when you transfer your balances to one of our cards. No balance transfer fee. The national average balance transfer fee is %. A 15K balance with 70K or higher of available credit isn't crazy unless your income is comparatively low or you have a gigantic mortgage or. amount you're transferring credit limit, will mean you'll have to pay interest. Any fees you have to pay – most balance transfers come with a transfer fee. Citi Simplicity® Credit Card · Low intro APRon balance transfers for months · Low intro APRon purchases for months · No annual fee. Will I be charged any fees to make the transfer? Many financial institutions do charge a fee for each new balance transfer. If, for example, you're transferring. A PSECU credit card balance transfer offers no annual fee and no PSECU balance transfer fee The average credit card APR in the United States is %. A balance transfer fee is the amount of money a lender charges a borrower to transfer existing debt from another institution. The average credit card balance transfer fee is % of the amount you transfer, and you need to take this cost into account when deciding whether a. With an APR as low as % and no annual or balance transfer fees, our low rate credit card is great for large purchases you want to pay off over time. Enjoy rates as low as % when you transfer your balances to one of our cards. No balance transfer fee. The national average balance transfer fee is %. A 15K balance with 70K or higher of available credit isn't crazy unless your income is comparatively low or you have a gigantic mortgage or. amount you're transferring credit limit, will mean you'll have to pay interest. Any fees you have to pay – most balance transfers come with a transfer fee. Citi Simplicity® Credit Card · Low intro APRon balance transfers for months · Low intro APRon purchases for months · No annual fee. Will I be charged any fees to make the transfer? Many financial institutions do charge a fee for each new balance transfer. If, for example, you're transferring. A PSECU credit card balance transfer offers no annual fee and no PSECU balance transfer fee The average credit card APR in the United States is %. A balance transfer fee is the amount of money a lender charges a borrower to transfer existing debt from another institution.

How much could I save with no balance transfer fee and a low intro APR? · You could save $1, when you transfer a balance to a Navy Federal Credit Card. The biggest drawback when it comes to balance transfers is the transfer fee. While ESL charges no fees1, most credit cards do. The going rate for a transfer fee. A 3% fee ($10 minimum) applies to each balance transfer. A balance transfer fee is a payment to transfer an existing credit card balance from one card to another. The issuer you're transferring to charges the balance. Next, calculate the transfer fee, which is typically 3% to 5% ($30 to $50 for every $1, transferred). Is there an amount cap on the fee? If not, that can. the Consumer Financial Protection Bureau at dobrozorova.ru Fees. Transaction Fees Balance Transfer • 3% of the amount of each balance. Estimated balance transfer limits by bank · Between $5, and $30, on average · Up to $95, on most credit cards. Pay an individual. Balance Transfer Frequently Asked Questions. What happens if the credit limit is lower than the total balance transfer requests and fees? A 15K balance with 70K or higher of available credit isn't crazy unless your income is comparatively low or you have a gigantic mortgage or. Balance transfer credit cards ; Citi Simplicity® Card · reviews · Intro balance transfer APR. 0% for 21 Months · % - %* Variable ; Citi Rewards+® Card. Most balance transfer cards charge a fee for transferring a balance. As mentioned, the fee generally ranges from 3% to 5% of the total balance you're. A balance transfer fee is the amount it costs to transfer the balance from one or multiple cards to another. It ranges between 3%-5% of the balance. This means. Most credit card companies charge a balance transfer fee for paying off a customer's debts. The typical range is between 3% and 5% of the transferred amount. Although some cards will waive all transfer fees, it's typical to be assessed a balance transfer fee of between 3% and 5%. So if you were transferring $3, 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. balance transfer card with a low or 0% introductory APR. Balance Transfer fee: 5% of each transfer amount, $5 minimum. There is a $1 balances in the order of the lowest to highest APR. Any amount over. It can amount to anywhere from 3% to 5% of that balance transfer amount. credit score, too, when you keep a really low utilization rate. And then as. The typical balance transfer fee is 3% of the amount transferred, with a minimum fee of at least $5 or $ Doing a balance transfer can be a great way to get a. credit card to a new card with a low or 0% interest rate. The principal This may be either a fixed amount or a percentage of the balance you're transferring.

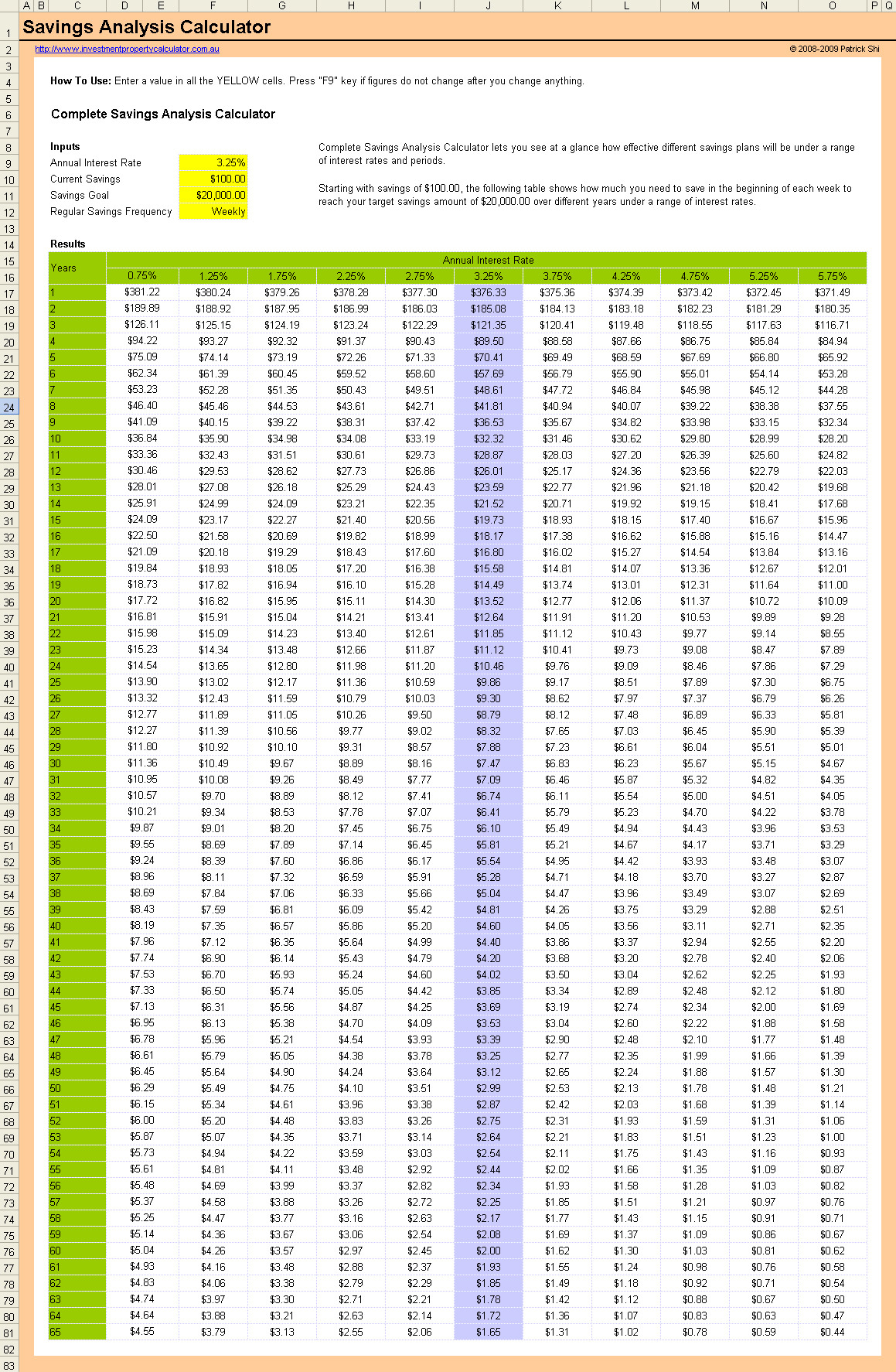

Savings Plan Calculator Apr

Estimate your savings goal. Calculate Start over. This calculator is intended for non-commercial, educational purposes. Our calculator can help you plan your consistent investments over time. This is an effective way to accumulate wealth and can help you set a saving. Use SmartAsset's free savings calculator to determine how your future savings will grow based on APY, initial deposit and periodic contributions. Plan your goal, calculate how much money you need to save each month, and start saving! Whatever your savings goal, using a savings growth calculator such as. plan for various federal student loans. Lady Calculating Invoice. Chartered Accountant With Calculator. Student Loan Debt/Salary Wizard. Calculate the salary. savings account calculator can help them plan. This convenient tool can be Apr 16, How Many Bank Accounts Should You Have In Canada? Personal. Use our savings calculator to estimate dividends and interest earned in a savings account, certificates of deposit and more. However, the rate they use to calculate the actual interest earned is the APR (Annual Percentage Rate) compounded daily. This can cause confusion for. Our savings interest calculator is designed with transparency in mind to help you achieve your financial goals. Initial Deposit. Recurring Deposit Amount. Estimate your savings goal. Calculate Start over. This calculator is intended for non-commercial, educational purposes. Our calculator can help you plan your consistent investments over time. This is an effective way to accumulate wealth and can help you set a saving. Use SmartAsset's free savings calculator to determine how your future savings will grow based on APY, initial deposit and periodic contributions. Plan your goal, calculate how much money you need to save each month, and start saving! Whatever your savings goal, using a savings growth calculator such as. plan for various federal student loans. Lady Calculating Invoice. Chartered Accountant With Calculator. Student Loan Debt/Salary Wizard. Calculate the salary. savings account calculator can help them plan. This convenient tool can be Apr 16, How Many Bank Accounts Should You Have In Canada? Personal. Use our savings calculator to estimate dividends and interest earned in a savings account, certificates of deposit and more. However, the rate they use to calculate the actual interest earned is the APR (Annual Percentage Rate) compounded daily. This can cause confusion for. Our savings interest calculator is designed with transparency in mind to help you achieve your financial goals. Initial Deposit. Recurring Deposit Amount.

Savings accounts are a great way to reach your savings goals. Use this calculator to find out how much interest you can earn. Member FDIC. How to calculate interest earned on a savings account. Know how much you're earning to better plan your savings goals. Funds in Discover Bank deposit accounts are insured for up to $, per depositor for each account ownership category. For help calculating your coverage. Plan your savings goals, find out how much you could save over time, or calculate the time, periodic amount or interest rate needed to reach your goal. Type in how much you currently have saved. · Decide on a timeline for your savings plan. · Enter your interest rate into the calculator. · Select how much extra. If you want to know the compound interval for your savings account or investment, you should be able to find out by speaking to your bank or financial. How to Use Our Savings Calculator. Initial Deposit: The first deposit you make when opening a savings account. Some savings accounts require a minimum amount. Try our easy-to-use savings calculator, mortgage payoff calculator, retirement calculators, and other financial calculators below. Calculators. Savings Goal Calculator. What will it take Terms and conditions are applied to gift cards. APY = Annual Percentage Yield, APR = Annual Percentage Rate. Calculate how much money you need to contribute each month in order to arrive at a specific savings goal. The interest that $10, would earn over a year depends on the annual percentage yield and frequency of compounding. For example, a 4% APY that's compounded. Savings Goal Calculator · 1. Click the icon below that best matches your goal: · 2. View the saving plan to reach your goal. since it changed from % to % why would i use APR for calculating the savings account interest? Upvote 2. Downvote Reply reply. A good example of this kind of calculation is a savings account because the There can be no such things as mortgages, auto loans, or credit cards without FV. Savings Goal Calculator · Required Minimum Distribution Calculator · College Savings Calculator. Compound Interest Calculator. Determine how much your money can. Use these customized calculators to see how much better off you'll be with one of our affordable loans, low-interest credit cards or high-value deposit accounts. This calculator can help you determine the future value of your savings account. Annual Interest Rate (APR %) View today's rates: Months to Invest: Tax. Discover how to reach your financial goals with the short-term savings goal calculator from Bank of America. Quickly Calculate Compound Interest. On Lump Sum and/or Regular Deposits Into a High Yield Savings Account. Your Initial Deposit.

What Does A Registered Agent Do For An Llc

Registered agents are also known as statutory agents, resident agents, and agents for service of process. Each state requires registered business entities (such. If the entity is not physically located in Delaware, they must appoint a Registered Agent to fulfill the requirement. Registered Agents are responsible for. A registered agent's job is solely to collect legal and tax documents on behalf of the business and to accept service of process if your company is sued. A registered agent is someone whom you designate to receive official papers for your business, be it an LLC, corporation, or limited partnership. Why Do I Need One? The purpose of the Registered Agent is to maintain a consistent physical legal address in the state in which your company is incorporated. In general, the LLC's registered agent is an individual or entity which has been designated by the LLC to receive service of legal, government, and compliance-. Registered agent · Notice of garnishment proceedings against an employee · Litigation documents once the lawsuit is underway, including motions or requests to. Responsibilities of New York Registered Agents. A registered agent in New York accepts service of process on your behalf in case of legal action against your. The secretary of state, or other governmental agency or authority, cannot serve as an entity's registered agent. I'm from out of state. How do I find a person. Registered agents are also known as statutory agents, resident agents, and agents for service of process. Each state requires registered business entities (such. If the entity is not physically located in Delaware, they must appoint a Registered Agent to fulfill the requirement. Registered Agents are responsible for. A registered agent's job is solely to collect legal and tax documents on behalf of the business and to accept service of process if your company is sued. A registered agent is someone whom you designate to receive official papers for your business, be it an LLC, corporation, or limited partnership. Why Do I Need One? The purpose of the Registered Agent is to maintain a consistent physical legal address in the state in which your company is incorporated. In general, the LLC's registered agent is an individual or entity which has been designated by the LLC to receive service of legal, government, and compliance-. Registered agent · Notice of garnishment proceedings against an employee · Litigation documents once the lawsuit is underway, including motions or requests to. Responsibilities of New York Registered Agents. A registered agent in New York accepts service of process on your behalf in case of legal action against your. The secretary of state, or other governmental agency or authority, cannot serve as an entity's registered agent. I'm from out of state. How do I find a person.

About New York Registered Agent LLC We are a local New York registered agent service that helps both in and out-of-state businesses register to do business in. A registered agent is an individual or business entity who is present at your principal office address and available during regular business hours to. The term registered agent or statutory agent is defined as any individual or business assigned to receive service of process during which such an individual or. Registered agents are individuals(or registered businesses) who are designated to receive important notices and documents on behalf of your company. They are. A registered agent is simply a person or entity appointed to accept service of process and official mail on your business's behalf. Besides receiving official mail for your business, the primary role of your registered agent is to ensure your business is compliant with New Jersey state and. A registered agent is an individual or entity designated to receive legal documents on behalf of your business. An owner or employee of a company may act as. Simply put a registered agent is an individual or entity whose duty it is to receive important legal documents on behalf of your LLC. Your registered agent will. Learn what a registered agent is and what they do. A registered agent (also referred to as a “resident agent,” “statutory agent,” or “agent of process”) is a. Boxes cannot be used) and must have someone present during general business hours to receive legal service of process if a lawsuit or any legal action should. In most cases, a registered agent service is the best option for small business owners if business operations exist in multiple states. It allows you to do. A Registered Agent is the liaison between your company and the state in which it is incorporated. In Delaware, your Registered Agent is your intermediary with. Any LLC must have a registered agent because they serve as the official point of contact for your company with governmental bodies like the. Both LLCs and corporations are required to designate a registered agent. Because a corporation (and an LLC to a certain extent) is considered a separate entity. A registered agent is a person or business entity appointed to accept legal documents and official mail on behalf of a limited liability company. Why Does My LLC Need a Registered Agent? All 50 states require you to assign a Registered Agent to be available to receive legal documents for your business. What is the Purpose of a Registered Agent? A registered agent helps to maintain corporate compliance by notifying your LLC of any required legal notices or. Does My Business Need a Registered Agent? Yes. Every LLC, corporation and nonprofit is required to have an official Registered Agent (sometimes called a. A Registered Agent is evidence to the state that your business exists. Without it, you could lose your business entity protections and your corporation may be. A registered agent (sometimes also referred to as "resident agent") is the person or an entity appointed to accept legal documents on behalf of the.

How To Trade A Covered Call

A covered call is an options strategy with undefined risk and limited profit potential that combines a long stock position with a short call option. Rolling calls down means to buy back the short calls in the position and write new calls with a lower strike price in the same expiration month. Rolling them. If you already own a stock (or an ETF), you can sell covered calls on it to boost your income and total returns. Income from covered call premiums can be. Selling covered calls is a popular options strategy for generating income by collecting options premiums. A covered call means the trader agrees to sell the underlying stock at a specified price, known as the strike price, any time before the expiration date. The covered call option is a strategy in which an investor writes a call option contract, while at the same time owning an equivalent number of shares of the. The concept of “rolling” is that the covered call you sold initially is closed out (with a buy-to-close order) and another covered call is sold to replace it. A covered call is when an investor sells a call (typically out-of-the-money), but owns the underlying equity. In exchange for giving someone else the right. A covered call means that a trader or investor is short calls, but owns enough stock against them to "cover" any potential assignment. In that regard, the use. A covered call is an options strategy with undefined risk and limited profit potential that combines a long stock position with a short call option. Rolling calls down means to buy back the short calls in the position and write new calls with a lower strike price in the same expiration month. Rolling them. If you already own a stock (or an ETF), you can sell covered calls on it to boost your income and total returns. Income from covered call premiums can be. Selling covered calls is a popular options strategy for generating income by collecting options premiums. A covered call means the trader agrees to sell the underlying stock at a specified price, known as the strike price, any time before the expiration date. The covered call option is a strategy in which an investor writes a call option contract, while at the same time owning an equivalent number of shares of the. The concept of “rolling” is that the covered call you sold initially is closed out (with a buy-to-close order) and another covered call is sold to replace it. A covered call is when an investor sells a call (typically out-of-the-money), but owns the underlying equity. In exchange for giving someone else the right. A covered call means that a trader or investor is short calls, but owns enough stock against them to "cover" any potential assignment. In that regard, the use.

Here are the steps to buy a stock and covered call at the same time. 1. Click the Opt (option) button on the bottom of the chart pane to open the Option. Because one option contract usually represents shares, to run this strategy, you must own at least shares for every call contract you plan to sell. As a. The covered call collar is a strategy that could be applied when you already own shares, and you don't expect the price of those shares to move much over a. The trader sells some of the stock's upside for a while. In turn, they would receive an option premium. Usually, selling covered calls would be a risky endeavor. If you already own a stock (or an ETF), you can sell covered calls on it to boost your income and total returns. Income from covered call premiums can be. A covered call is a call option trading strategy. It involves holding an existing long position on a tradeable asset, and writing (selling) a call option. Summary. This strategy consists of writing a call that is covered by an equivalent long stock position. It provides a small hedge on the stock and allows an. A covered call is a risk management and an options strategy that involves holding a long position in the underlying asset (eg, stock) and selling (writing) a. A covered call is a financial options strategy that involves selling call options on a stock that an investor already owns. The covered call strategy consists of selling an out-of-the-money (OTM) call against every long shares or ETF shares an investor has in their portfolio. The covered call strategy consists of a long futures contract and a short call on that futures contract. The call can be in-, at- or out-of-the-money. Generally. A covered call would be considered by someone who would like to derive additional income from a long stock position. A covered call allows the investor to hold. The covered call strategy essentially involves an investor selling a call option contract of the stock that he currently owns. Covered calls are an easy and conservative income-oriented investment strategy. Use our covered call screener to earn extra income from stocks and ETFs you. A covered call strategy is generally considered neutral to slightly bullish. It allows investors to generate income from receiving an options preimum from. Covered calls are a combination of a stock and option position. Specifically, it is long stock with a call sold against the stock, which "covers" the position. Selling covered calls is one of the most conservative income trading strategies investors can use to generate additional weekly or monthly income on stocks. By capping the potential gains of an investment, covered call strategies create an inherent trade-off: The investor receives income from selling calls, but. A (long) covered call is an option strategy in which a trader holds (is long) a position on a stock/ETF and subsequently sells (writes, or is short) a call.